Updated 4/17/2024

Have you ever been a victim of marketing timing and inevitably lost a lot of your money? So many new investors fall victim to marketing timing over and over again, so the real question is—how can I avoid the trap of market timing?

Let me help out with some concrete tips!

Click to jump to a section:

- Learn From My Mistakes

- Why Market Timing Doesn’t Work

- Ways to Avoid Market Timing

- Ways to Safely Try to Time the Market

Learn From My Mistakes

When I first started investing, I thought I was going to be the best investor alive and that I was smarter than everyone else—turns out, that was not the case!

My process was this – I bought shares of three different companies. One was from the company I work for; one was from a Master Limited Partnership of the company I work for, and then the last was from a stock that I googled “best stocks to buy under $10.”

Seems like a great process, right?

Wrong!

Buying stock in my own company was a great idea because I was familiar with the company and the industry. However, buying stock from a random company with the intention of quickly trading it was not a great idea.

It’s not even the fact that I bought a random company. It is important to get your feet wet in the market to solidify financial terms and concepts.

The problem was that I bought it with the intention of day trading it.

I knew next to nothing about the company – how would I day trade it?

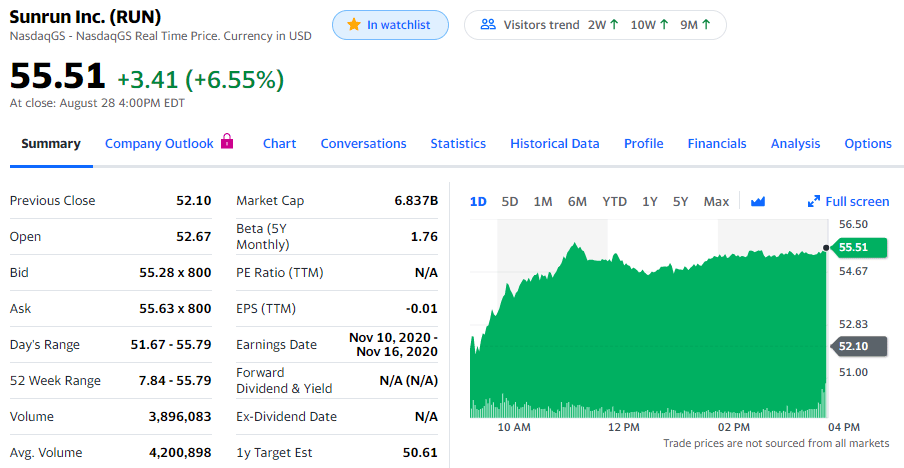

Well, the company that I bought was Sunrun (RUN) at a price of $7.93/share. I ended up trading it around a bit, losing a decent amount of money, and then eventually decided just to hold my shares. At the end of the day, I sold it for around $14, so a pretty nice return of about $6/share! Unfortunately, I only profited about $3/share because of paying so many trading fees.

It was still a great return, but way worse than if I had simply held the stock.

And if you’re curious about how RUN is doing right now, let’s just say it pains me:

Market timing involves trying to predict the market and then buying in and out of stocks to maximize gains.

Basically, you want to buy on the dips and sell on the peaks, so even if a stock only goes up 10%, you’re trying to make more by buying and selling multiple times to get an even larger return.

This is typically more common in volatile stocks that have major swings up and down as that creates more opportunities to make money…but also more opportunities to lose money!

Why Market Timing Doesn’t Work

I am personally against market timing because it’s a surefire way to lose money for the average investor.

If you’re like me, then you’re not special. Any information that you get about a specific stock is all common knowledge by the time you read it. So, trying to trade off common knowledge is a dangerous game because you’re the last person to know that info.

Trying to trade off news and market movement is like making a one-in-a-million bet that you are early enough to take advantage of the news, but late enough for someone to have already posted about it.

I think all first-time investors think that they can time the market because it doesn’t seem that hard, but it is. Every day on CNBC, I would hear about the “Robinhood Traders” who were trying to time the market during COVID-19, and it would crack me up.

I literally heard one analyst say that she’s shorting Kodak because the stock has been fairly steady lately. She thinks that the Robinhood Traders will get bored and sell their stock to invest in the next shiny thing.

It sounds insane but also not an awful idea. Robinhood is an app that attracts first-time investors, and I think it also brings out the day trader in those investors. Not to mention, the app is set up to make people want to day trade.

I used to use Robinhood and I switched to Fidelity after Robinhood crashed and I will never, ever go back. There are so many different options to Robinhood so I urge you to really consider all options before making a final decision.

The good news is that no matter where you’re investing or how long you’ve been investing, there are concrete steps that you can take to make sure that you stay a rational investor!

Ways to Avoid Market Timing

Trust the history of the stock market

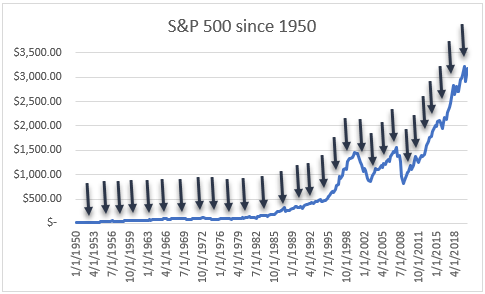

I think that this is a big one for me to stay rational. The stock market has a 100% success rate of going up over the long term, so as long as you can trust that the market is going to continue to do that, it should help you avoid partaking in any sort of marketing timing.

I mean, look at all of those good buying points as long as you are investing for the long term. Even if you buy at a point that then immediately dips, you can see that the market fully rebounds within a few years.

There is hardly ever a reason to invest in anything but the overall market, especially for beginners. It’s simply the lowest effort, closest thing to a guarantee you can get in the market.

Create speed bumps when you’re investing

The biggest speed bump is that I do not actually have my Fidelity app on my phone, which keeps me from making irrational decisions about selling or buying stocks. I only make transactions on my computer, and while logging onto a computer isn’t some major hassle, it takes a little more time than simply logging onto an app and hitting that buy or sell button.

I’ve talked about this before on the podcast and honestly, it has been a big help in my investing returns.

Another one is that I will not watch CNBC with my phone. It sounds insane, but when I hear people talking about stocks, I pull them up on my phone. In the past, I’ve made an irrational decision and bought or sold stocks literally at that moment.

Some analysts will say things like, “Buy this stock at $42 and then sell at $45.” That is timing the market! This is exactly what I am trying to avoid, but it is exactly what my brain wants to do because it seems like a locked-in $3 gain, right?

Until it doesn’t happen…

I love watching CNBC, and when I don’t have my phone, I can’t make these bad choices, so I watch it but leave my phone in a different room.

Honestly, these speedbumps can sound as ridiculous as necessary, but as long as they keep you from timing the market, you’ll be a better investor!

The point is that any speed bump you can put between you and making a rash investment decision is worth it.

Only look at your portfolio periodically

This tip is something that I think is imperative to try to help you stay away from frequently trading. The more that you look, the more likely you’re going to be to make an impulse decision. It’s human nature!

One thing you can do is try to look only when the market is closed. Maybe that means in the AM and PM before/after trading hours, only on the weekends, or only once/quarter!

If you look only when the market is closed, then even if you want to make a buy/sell, you can, but it won’t actually happen until the market opens, therefore reducing some of the gratification of making that trade.

I know many investors who simply set up automatic investments and only check their portfolios once a month. These check-ins are more to ensure everything is investing properly, not to make investment decisions.

Do your own analysis

This one seems obvious but when I bought my first stock, and even many others after that, I wasn’t ever doing my own analysis. Refusing to buy a stock until you do your analysis will benefit you in two ways:

1 – you have an immediate “speedbump” built in because you can’t do anything until you take the time needed actually to go through and review that stock. Personally, I like to analyze a stock over a few days or even a week, so this is an immediate speed bump to slow things down for me from trying to trade or make an impulse decision.

2 – when you do your own analysis then you understand the company very well and trust what they do. A lot of times, day traders will sell off very small gains and then buy back at lower points, but if you trust the company and think it’s undervalued, are you going to sell after a 1% gain? Doubtful.

You will likely want to hold onto that company unless something materially changes, right?

So, if you do your own analysis, you’re much more likely to actually be able to calm any sort of desire to day trade, therefore making you much more content with simply buying and holding, a strategy that most of us should only be partaking in.

Set it and forget it

Whether you’re someone that dollar cost averages or someone that’s a lump sum investor, if you’re investing on a schedule and then you forget about it until the next time you put money in, maybe that’s every paycheck or at the end of the month when you have leftover money in your budget, then you’re going to be less likely to make impulsive decisions.

Personally, I have a Dividend Aristocrats of the Future portfolio, and I love getting paid every two weeks to invest in whatever company has the lowest current portfolio value. I try to keep them all balanced, which allows me to focus on undervalued companies.

By only investing more money every two weeks, I completely avoid thinking about selling those stocks and only think about getting paid and adding more to my portfolio.

Ways to Safely Try to Time the Market

Post-Audit yourself

I think this is by far the most important one. Make sure to keep a very thorough tracking system of your buys and sells and track to see how you did. If you don’t do this, you’ll never know if you actually made money.

I am a huge fan of benchmarking yourself to the S&P 500 but in this case you should benchmark yourself to the actual performance of the stock. If you buy and sell 3 times during which a stock goes from $50 to $60, did you make more or less than $10/share?

Truthfully, I bet you made less, so tracking this can help expose you to that and potentially give you some quantitative reasons to avoid market timing.

Learn early & cheap!

If you are going to engage in market timing, do so right away and for a few reasons:

1 – you likely will have the least amount of money in the market so trying to time it and failing won’t be as big of a mistake

2 – you’re likely going to have this itch at some point in your investing journey, so if you can learn early on that it doesn’t work well for you, then you’re likely not going to have that itch later in life when you have more money at risk.

Set aside a certain amount to be speculative

If you find that you just can’t avoid it, then limit a specific allocation of your portfolio to it. Personally, I love to engage in speculative investing, but I know that it is much riskier, so I will limit the amount that I can be speculative with.

Even when being speculative, I’m still not timing the market but just picking more speculative stocks. If you find that you have to keep timing the market, or maybe you have discovered that you have a track record of success doing it, limit your portfolio to only 10% being in this market timing aspect.

If need be, just open a separate account so that the money is completely separate from the rest of your portfolio and the lines never get blurred.

Look at your portfolio daily

I look at my portfolio daily because I think it has eventually made me numb to major swings in the market. During the early stages of COVID-19 when the market was dropping 10% in a day, I wasn’t selling at all. I was buying.

By learning from my lessons earlier in my investing journey, I learned that if the market was going to crash, it would create buying opportunities. Looking at my portfolio early in my career numbed me to these major changes, so instead of panicking, I was calm and knew exactly what to do.

Strengthen your risk appetite

When you’re market timing, your risk appetite is likely to become stronger. Overall, this is a very good thing, as long as you put it to a good use. By strengthening your risk appetite, you will be much more likely to avoid buying high and selling low, likely because you’ve made those mistakes before.

Every day, I try to become more welcoming to risk, so focusing on trying to strengthen my risk tolerance has helped me a lot in my investing journey.

It has kept me from trying to time the market because I know that things will eventually rebound, even if I buy in at a point where things still continue to get worse.

Don’t repeat mistakes

This is an easy one to say but hard to implement: When you make mistakes, write them down with details and make sure they’re never repeated. The best way to avoid mistakes is to learn from the ones you’ve already made.

Summary

Do I Time the Market?

Short answer – no.

Long answer, it highly, highly depends. Basically, in one situation, I will. Let me explain:

In 2020, when COVID-19 was just getting going, the stock market crashed by 30%. I didn’t think that this was going to be a super long-term thing, and I didn’t think that COVID-19 was permanently changing every single business, so I invested in some companies that were getting hammered.

A couple of those were ROKU and PFGC, both companies that I thought were being unfairly punished. They have rebounded quite nicely in the few months since COVID-19.

If you want to pull forward some money to max out an IRA earlier than originally planned like I did, I have no issue with that. But if you sit there and trade in and out of stocks for market timing, prepare for some turbulence ahead!

Related posts:

- Inversion Thinking: How Charlie Munger Avoids Stupidity with Investing In today’s post, we will discuss ways to use inversion thinking to avoid stupidity with investing decisions. Using a framework established by Stoics such as...

- How Often to Monitor Portfolio? Controversial Take, But I Say DAILY Anyone and everyone will tell you that you shouldn’t check monitor portfolio performance too often because it is going to cause you to make an...

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- Risk Management For Beginners When you invest your savings, you are taking on risks. This is an unavoidable fact for investors. Even if your entire portfolio is United States...