I feel like the debate of sector investing is one that has lasted ages and so many people have different opinions on the practicality of it. Truthfully, I think that investing in a particular sector that is primed for a rebound makes a ton of sense, but there’s also some risk involved.

For the most part, there are 11 primary sectors in the stock market, including:

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Information Technology

- Materials

- Real Estate

- Communication Services

- Utilities

Within all of these different sectors are many different subsectors that can get even more specific, but these are the main 11 categories that the stock market is broken up into.

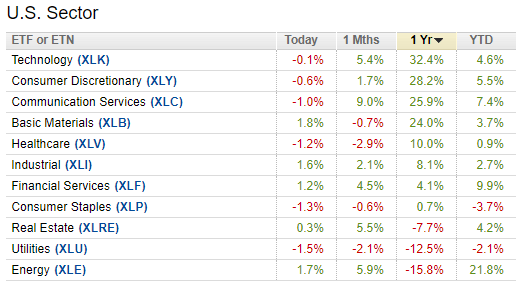

Seeking Alpha has a pretty nice breakdown of some of the ETFs that you can pick if you wanted to invest in a particular sector:

One thing about ETF investing, however, is that you can always find tons of different ETFs that essentially accomplish the same goal. This is nice because you can essentially price shop by finding the lowest expense ratio but also, I have found that the ETFs are all just slightly different in how they operate.

Anytime I want to find specific information on ETFs, I always go to ETF.com because it’s such a large database of all the information that anyone could possibly want with an ETF. I find it extremely helpful as I can search any and all ETFs to find their holdings, performance, expense ratios, etc.

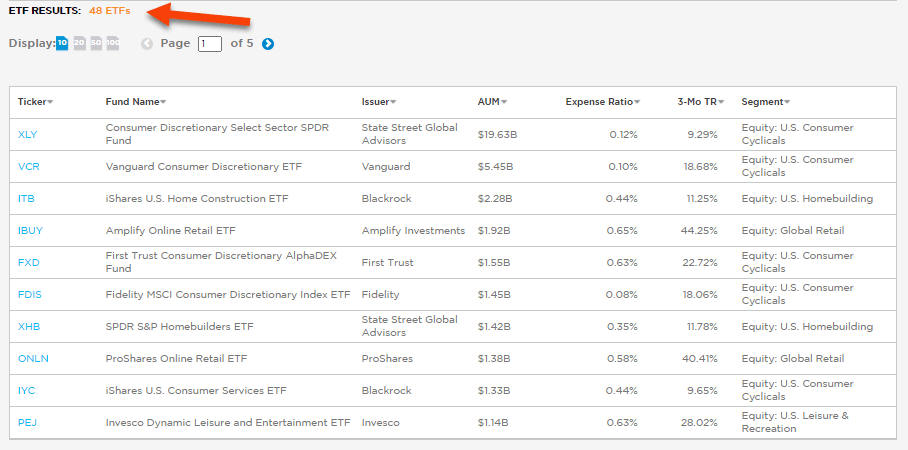

When I type “Consumer Discretionary” into the search bar, I get 48 different ETFs that would fall into this category:

Admittedly, this can be extremely overwhelming and make you immediately exit the screen. I have done that before.

Performing analysis on an ETF can be even harder than doing so on a stock because there are so many different variations of what you’re likely looking for.

You can see that they have general descriptions in the Fund Name column that can help guide you, but in general, I will look at the AUM, or Assets Under Management, to get an idea of just how big that ETF is.

Typically, the larger the ETF is, the more mainstream it is, and less likely to be niche. AKA – if you’re looking to get all of the consumer discretionary companies in the stock market, it’s likely going to be in an ETF that has a higher AUM.

You can see the top two ETFs both explicitly say “Consumer Discretionary” in them, meaning they likely are just grabbing that sector of companies.

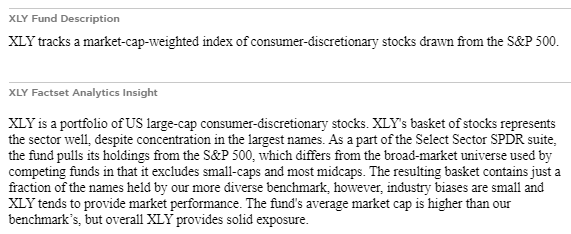

Sure enough, when I click on XLY I can see that the description tells me exactly what I assumed:

Just as I did this for consumer discretionary, you can do it for any sector of the stock market to find an ETF that matches the industry that you’re looking for exposure to.

Now, the Investing for Beginners gang is primarily focused on finding companies that are undervalued vs. their intrinsic value, aka value investing.

How can you find an ETF that is undervalued?

Some people say that the easiest way to do this is to simply look at the price performance of that ETF over recent history. Personally, I’m not sure I agree with this. To me, investing in an ETF with a specific strategy is nearly impossible to accomplish.

Within any industry, you’re going to have some companies that fall into the value bucket while some are growth. Does 75% value and 25% growth mean it’s better? Worse? Who knows honestly? I mean the value vs. growth debate is one that is perpetually ongoing with no end in sight because of the cyclicality of stocks.

In my opinion, there are three reasons to invest in ETFs:

1 – Stability in your portfolio

Investing in an ETF will bring you stability as you’re investing in many different companies rather than one company. If you invested in a company and it went bankrupt, you lost your investment. If you had invested in an ETF, that investment would drop slightly but you’d still have a majority of your investment.

On the other hand, “stability” is going to cost you upside in investing. If you invested in a company that became a tenbagger, your investment is now worth 10X. If you owned an ETF, your investment went up slightly because you only own a small amount of that company.

ETFs minimize risk. That might be good or might be bad – 100% depends on your investing philosophy.

2 – You want to be hands-off

You can simply dollar cost average into your ETF on a ratable basis without doing analysis. Just keep throwing money in blindly and watch your account balance grow.

Now, I do think that this might be slowly leading us towards an ETF bubble solely because of the nature of how some people use ETFs, but as long as you keep adding you’re going to be just fine. Your returns might be less than others picking individual stocks, but nobody ever went broke by investing in ETFs.

3 – You want exposure to a new market

This is my #1 reason to invest in ETFs. I will invest in an ETF like WCLD to get cloud computing exposure or GLD to get exposure to Gold before buying individual companies.

Basically, I get some skin in the game and then I try to learn more about these companies and use my stock picking process to pick out stocks that I think are going to be winners.

Notice how I didn’t say that I invest in ETFs to get the biggest return possible? I just don’t think that’s how ETFs are meant to be structured, but I actually have heard some recent opinions that I want to put to the test.

I have heard two different philosophies recently focused on buying ETFs based on how they have performed lately.

Basically, there was a value and then a momentum philosophy. Value was that if you bought the worst performing sector in a year and then held it for the next year, you would beat the market.

The momentum strategy was the same but opposite – buy the best performing sector and hold it for the next year.

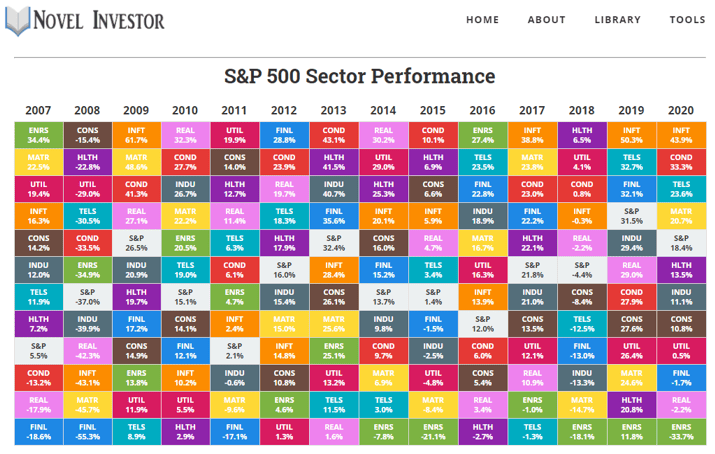

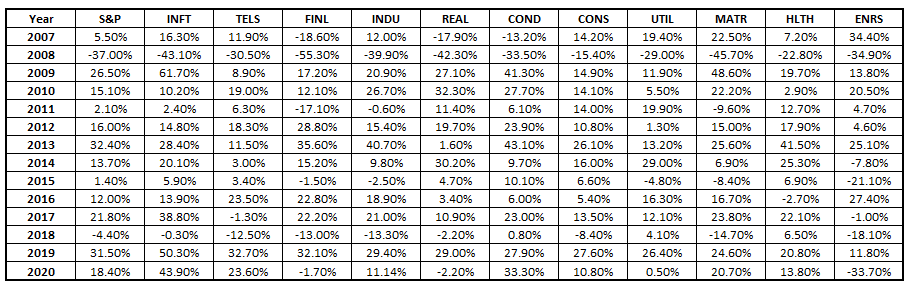

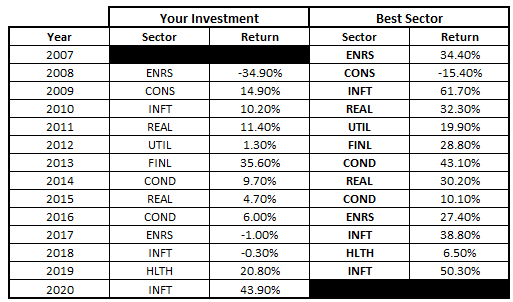

The Novel Investor has this really cool, interactive chart that shows us how the different sectors have performed since 2007, shown below:

I like how they ranked the different sector and then shaded them as well. Well, you all know me – I had to immediately go to Excel and start to crunch some of the numbers myself.

Below shows the chart of each sector by year compared to the S&P 500:

This is great info but at the end of the day, we really just want to see how the sectors actually compared to the S&P 500, right?

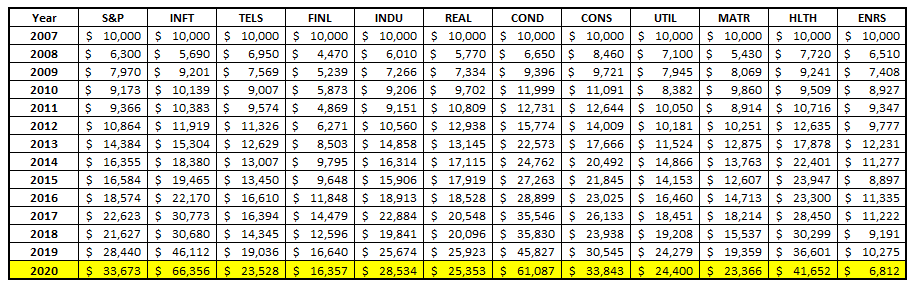

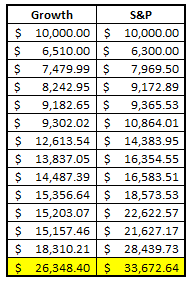

Below shows what would’ve happened if you invested $10K into each sector, as well as the S&P 500, starting in 2008:

As you can see, the S&P 500 had a pretty nice return of turning that $10K into nearly $34K. Now, it’s important to note that this doesn’t include dividends whatsoever – purely price performance.

At the end of the day, there were 4 sectors that outperformed the S&P 500 while 7 underperformed. INFT, or Information Technology led the pace and essentially doubled up the S&P 500 while ENRS, the Energy sector, lost 32% of the initial investment!

But what happens if we try these two different strategies that I mentioned where we buy the best or worst performing sector for the following year?

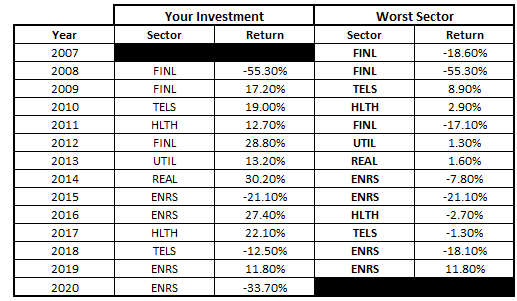

Let’s start with the “value” approach of buying the worst performing sector. Below is a chart that shows the worst performing sector in a particular year and then the investment that you would’ve made during that time:

For instance, you can see that in 2007, the worst sector was Financials at an abysmal return of -18.6%. That’s so bad it’s hard to even use the word return to describe it!

But wait – it gets worse! The next year you invest in Financials again because it was the worst sector and your return is -55.3%. Sad Face.

Ok – let’s run it back again with the financials. Wow, a nice return of 17.6%! Well above the normal S&P 500 average return of 10%. WINNING!

But wait – the S&P 500 return that year was over 26%. So, yet another loss. Things aren’t looking great anymore.

If you’d keep this up through 2020 you would end up with $10,616 – a massive underperformance vs. the S&P 500:

Not only that, but this strategy actually underperformed every single sector except for Energy. Seems like doing this is a massive, massive failure.

“But Andy, we have been in a 10-year bull market where growth and momentum have ruled!”

You’re completely right. Value has been a major drag in the 2010’s. Does the momentum and growth strategy end up looking better than value?

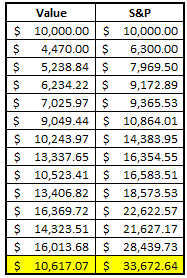

Below shows the best performing sector each year and the performance if you had invested the following year:

That 2008 year immediately sticks out to me as a massive failure but when I look further, it actually beat the S&P 500 that year.

Seems weird that losing 35% can beat the stock market as a whole, but that’s why I preach the importance of benchmarking your performance against an index, such as the S&P 500 which is what I use.

If you can get into the mindset that the S&P 500 is your “alternative”, or my view as the risk-free rate, then you’re going to be much calmer about major swings in your account.

If you can get to the mindset that the stock market is going to do what it’s going to do and instead just focus on beating the market, you’ll be much better off.

You’ll find yourself being happy when you lose 10% and the market loses 12%, just as you’ll be disappointed when the market gains 12% and you gain 10%. It’s the mindset and the healthy one to have!

Sorry for the tangent – let’s get to the results!

Womp womp…

While the growth drastically beat the value approach, it still underperformed the S&P 500, and that’s even with some massive years like Information Technology being up nearly 44% in the last year.

So, in summary, neither of these theories work…at all.

Sure, you can certainly implement them fairly easily, but to me it’s nothing more than a lazy way to try to outsmart the market, and it turns out that neither one of them work.

If you’re going to use ETFs in your investment portfolio then make sure you stick to using them for one of three purposes that I talked about earlier – adding stability to your portfolio, being hands off or gaining exposure to a new market or sector.

Using them in a way other than that is simply just nothing but a gamble.

It might surprise you, but I absolutely use ETFs in my investments. I have many different accounts between 401K, IRA for myself and my wife, brokerage accounts, account for my son, and others. I can’t pay attention to 50 different stocks so I absolutely will use ETFs to help me get some exposure to accounts where I just don’t have the mental capacity to be constantly managing them.

And as I mentioned, even in my actively managed accounts that I have, I will use an ETF like WCLD just to get some skin in the game while I research those cloud companies even more.

But will I try to pull a fast one with a “scheme” like buying the worst or best performing sector for the following year?

No. It doesn’t work. The market isn’t a place where you can get rich quick with stupid things like that.

Instead, buy companies and ETFs that are going to set you up for the future.

Primarily I am a stock picker and always will be – but that’s because that’s my investing philosophy. If you don’t know what your philosophy is then that’s the first place you need to begin, because investing without a plan is a dangerous pitfall to fall into.

I often hear people say they will pick an ETF over individual stocks because they can’t handle the risk. That’s not a bad plan, but I recommend you also work to change your risk appetite…your gains will thank you, and it’s not as difficult as you might think!

Related posts:

- Expanding Your Circle of Competence by Investing in Cloud Stocks Pre-2020, cloud stocks were never anything that I really even looked at investing in. The numbers just absolutely never made any sense to me but...

- A Few Reasons why Investing in eSports Could Result in Massive Gains Have you ever considered investing in eSports? If not, you could really be missing out on some major potential gains. In a recent Investing for...

- What are the Stock Market Sectors? – Global Industry Classification Standards One of the most common ways investors think about a company and analyze their portfolio diversification is by sector. There are 11 main sectors used...

- Investing in Biotechnology Companies: Pros and Cons Andrew and Dave recently talked about investing in Biotechnology Companies on their podcast and it was by far, one of my favorite episodes that they...