One of the most common excuses that I hear for why people don’t invest is because they don’t have enough money to do it. Well, excuse me, but that is just bogus, especially in today’s investing world! I implore you to start investing now because even small investments add up – and the data shows it!

I’ve had people tell me before that they don’t invest because they don’t have the money to do it. To me, this is just not possible. If you are broke then investing is even MORE important to you and your long-term financial success. It makes me think of my situation when I was in Chicago where my wife and I were struggling to save for our short-term goals.

We knew that if we only thought about how to save for our immediate goals then we were going to be in this constant hamster wheel forever. We needed to find a way to get ahead and just always looking at the thing right in front was not the way to do that. We had to get ahead.

We did this by starting small and putting as much money into the market as we possibly could. Essentially, I convinced myself that this needed to be a complete lifestyle change. Things had to be cut out of our lifestyle to try to put it in the market to set us up for a better situation in the long-term! But it all started with small investments.

As I mentioned, this literally began with us cutting certain things out of our budget and finding ways to save. For instance, saving money by buying groceries online or maybe even using Seated or Yelp to save a ton of money when we went out to eat.

We really took this time to try to live a minimalistic life as much as possible, which to me, is really code for ballin’ on a budget because you can still be on a budget and have a ton of fun if you take the time to do a little research and planning upfront.

When we were going through this process in Chicago, we even had to go through two major things in our investing journey that are no longer relevant!

- We had to buy full shares of companies

- We had to pay $4.99/transaction

I know that this makes me sound like the person that would say “we used to have to walk 5 miles uphill to school…both ways” but I am just pointing out that I found the value even back then with these major hurdles to I know that the value is there now, since almost every single brokerage firm has no transaction fees and a lot of them allow you to purchase fractional shares!

The fact that neither of these are barriers that you need to hurdle now should remove any reservation that you have about investing with small amounts of money. Now you can simply just buy whatever company you want, in whatever dollar amount that you want to invest, and not pay any fees for it – that’s a win win!

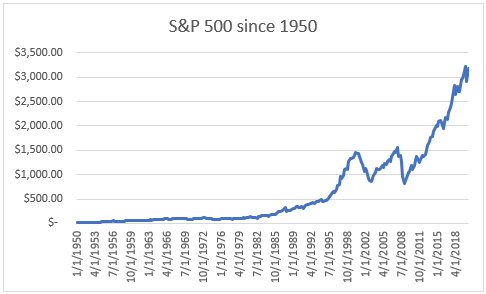

Another reason that I hear that people don’t want to invest is because the stock market is because the stock market is risky, and if they only have $20/month extra, they don’t want to put it into something risky! Well, my friends, I have good news for you – yes, the stock market is very volatile, but it isn’t risky at all!

In fact, the stock market has done nothing but go up over time, including an average Compound Annual Growth Rate (CAGR) of 11% since 1950!

Sure, there are some dips in there, but if you were to just hold on and not sell, you’d be sitting at a much, much higher price!

Hopefully any reservations that you might have are now put to rest, so now let’s get into some very realistic examples of things that you can do to kickstart your financial independence journey.

Packing Lunch

One example that I have talked about in the past is packing your lunch and how if you could just pack your lunch at a cost of $3/day instead of going out to eat for $10/day, then you’re going to save $7/lunch. I know that I bring this up a lot but it’s for good reason – literally anyone can pack their lunch but they don’t because they “don’t have time” which means they’re lazy.

Going out to eat takes, what, an hour? Or even going to the cafeteria at your work probably takes 10 minutes, right? 10 minutes*5 days/week is 50 minutes. Chances are, you’re already going to the grocery store, so as long as you can get the extra groceries and cook your meal in 50 minutes, you’re actually saving time.

And even if it takes an extra few minutes, if you did this every single day of the week then you’re saving $35/week! I would put in an extra hour of work for another $35, without a doubt.

Even if you only did this for only one day/week, that’s still $30/month! I know that $30/month might not seem like a ton of money, and I agree with you, but it’s something small that that can definitely add up over time.

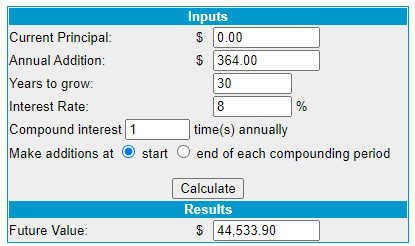

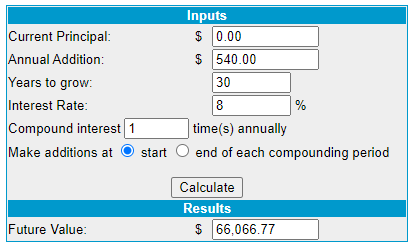

Anytime that I’m wanting to see how my money will compound over the course of time I go to a compound interest calculator and just type in the pertinent details.

So, in this case, you would put in $360 for the annual addition ($30/month*12 months), the years to grow (I like to assume 30 but if you’re 50, maybe put something less; if you’re 20, put something more), and then the Interest rate. I always like to use 8% because I think it’s a conservative estimate based off the 11% average since 1950.

When I input all of those things, I get a pretty nice chunk of change in 30 years!

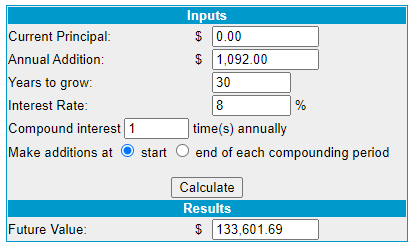

If you did this for just three days/week, it would increase all the way up to nearly $134K!

This is a simple change that is just about mindset!

Eliminating Netflix

Maybe you’re deadest on keeping cable, and that’s fine, but do you need Netflix as well then? Maybe you do, and there’s no problem at all with that! I 100% support for people to keep paying for the things that they want and the things that bring value to their life but if it doesn’t cut it out!

As Ramit Sethi says, “Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.” I really resonate with that quote because it’s empowering and motivating. Buy what you want, cut what you don’t love. That’s it.

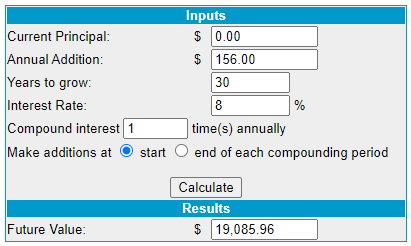

Netflix is cheap at only $13/month for HD (why would you not get HD, or better yet, why is there even a SD option?) but again, that can add up over time.

Sure, $19K isn’t some earthshattering amount, but it’s $19K closer to retiring early!

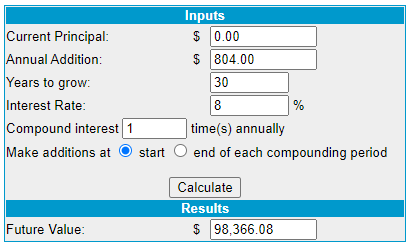

This is just with $13/month of Netflix, too! If you were to make a decision to cancel an $80/cable bill and instead get a $13/month Netflix subscription, meaning you’re saving $67/month, that would have even bigger impacts!

$98K isn’t anything to joke about! If you’re looking to retire with $1 million, which could be a realistic number as long as you know your retirement number, then you’re 10% of the way there just by getting rid of cable!

Cheap Week

This is one of my favorite ones and one that my wife and I are doing this week! We really challenge ourselves, usually once/month, to try to spend as little as humanly possible on groceries for that week. Our goal is to spend $2/meal/person, so in total, you’re looking at $84 for us both for 21 meals each. Throw in say another $16 in snacks and we’re at a cool $100. $100 might still seem like a lot to some people, but we eat very, very clean with fresh fruit, vegetables, lean meats and healthy carbs.

On top of that, it appears that my son has a dairy intolerance and as he’s only 4 months old and my wife is breastfeeding, she gets the fun of avoiding dairy too.

And guess what – non-dairy alternatives are not cheap! Like, a pack of cheese is like 6 bucks. But I dare you to try to tell your wife, who’s 4 months removed from pregnancy and just sacrificed her body for your child, that she can’t have FAKE cheese because it’s too expensive. I’d pay $60 to avoid that conversation!

Of course, it’s not always easy to hit this goal. Most of the time we will actually spend more than our goal, but we’re definitely spending less than what we would normally spend. It’s just a fun, creative thing that we will do one week/month to try to see how cheap we can eat.

Sometimes I’ll even challenge myself to do it during the week just for my meals that I’m on my own, such as breakfast, lunch and snacks. It’s really exciting to see how low I can go and still be healthy!

For instance, my breakfast costs $.64/day and it’s a well-balanced meal. It’s 1 serving of oats and three eggs with onion and jalapeno. I make them in muffin pans so that I can make 12 at a time so I just microwave them in the morning to save time.

Look good?

Pardon the Purdue mug…that’s where my wife went to school…go badgers! PS – I’ve found that making oats in a mug is much easier than a bowl if you’re doing one serving of instant oats.

Usually we will spend around $120 or so a week when we do this, which is $20 over our goal but still really good when we normally would spend $175/week.

So, we’re saving $45/week or $540/year! If we were to take this money and invest it, we could be sitting at just over $60K in 30 years!

Not too shabby for eating a really good meal on a budget!

Stay in Instead of Going Out

I talked about a scenario in my list of minimalist living tips and I think it hits spot on!

If you’re craving a burger, are you better off paying $12 for a burger for yourself and your spouse, plus another $10 for an appetizer, $6 each for a beer, and then a 20% tip. So, before you know it, you’re sitting over $55 for a meal…. of burgers. Or, you could likely make that same meal and buy a 6 pack for under $20.

I know that some people absolutely have that need to get out of the house and do things, and if that’s you, then go! But if you get as much fun staying in, grilling out, drinking some Corona (not the virus) on the back porch like I do, then why are you paying extra to go out? Plus, you have to put on some nicer clothes, drive, wait to be seated, and a bunch of other nonsense. I’d rather just stay home and eliminate all of those things…and save $35/meal!

When we lived in Chicago, we ate out probably 3-4 times/week, partially because we were trying to complete a “Chicago Bucket List” and do as many cool things as we could, but also because we didn’t have an outdoor space, grill, or anything that made cooking at home meaningful or enjoyable.

We targeted that in our home when we moved and it has literally paid off, especially during this coronavirus pandemic, because we’re completely fine with just staying in and saving the money…and STAYING HEALTHY!

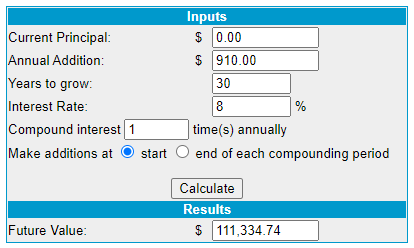

By us saving this $35/meal, say 26 times/year because we still do like to go out to eat, we’re saving $910/year!

Investing that $910 would turn into over $111K in 30 years!

The thing with all of these changes is that none of them are hard at all. Like, not at all. Simply by packing your lunch 3 days/week, cutting out Netflix (and keeping cable!), doing 1 cheap week/month and choosing to stay at home for dinner just one time every other week, you could end up with over $324K in 30 years! Nearly 1/3 of the way to $1 million for changing 4 simple habits!

The thing is, anyone can do these and they start with you just making small investments. I URGE you to get started now because everyday that you wait, you’re losing money, so don’t even think about it and get started!

Related posts:

- 17 Simple Minimalist Living Tips for a Maximum Life The Financial Independence, Retire Early (FIRE) community is all about cutting all expenses, maximize income, and retiring ASAP. While that in theory sounds great, I...

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...

- Retiring at 55? 9 Tangible Steps to Turn that Goal Into a Reality! Are you pumped for this blog post? I hope so! I know that I am extremely pumped to write it and show you all about...

- The Ultimate Guide to an Effective Family Finance Meeting Do me a favor and before you read anything further, go use the bathroom. Get yourself a drink. Eat a snack. Get ready, because this...