Analyzing a balance sheet is like peering under the hood of a car; it reveals a company’s inner financial workings and health. The balance sheet gives you insight into management and business strength.

For investors, understanding the balance sheet is crucial for making informed decisions.

This article takes a practical approach by focusing on Amazon, a global e-commerce and cloud computing giant that many investors are familiar with. It aims to demystify balance sheet analysis by using ten key financial ratios.

In today’s article, we will learn:

- The Basics of a Balance Sheet and its Importance

- The Importance of Financial Ratios for Analyzing a Balance Sheet

- Case Study: Analyzing Amazon’s Balance Sheet with 10 Metrics

Okay, let’s dive in and learn more about analyzing Amazon’s balance sheet with ten metrics.

The Basics of a Balance Sheet and Its Importance

A balance sheet is a fundamental financial statement used by accountants, business owners, and investors to assess a company’s financial health at a specific time.

The balance sheet is part of the big three investors need to understand:

- Income statement

- Balance sheet

- Cash Flow Statement

The balance sheet provides a snapshot of what a company owns (its assets), what it owes (its liabilities), and the value left over for its shareholders (equity). Understanding a balance sheet is crucial because it reflects the company’s operational efficiency, liquidity, financial stability, and overall health.

The importance of a balance sheet in financial analysis cannot be overstated.

It offers insights into a company’s financial leverage and liquidity and how effectively it uses its resources to generate earnings.

The balance sheet shows the company’s risk profile and financial condition for investors and creditors, which is essential for making lending or investment decisions.

- Assets are what the company owns and can be classified into current assets (cash and other assets likely to be converted into cash within a year) and non-current assets (long-term investments, property, plant, and equipment).

- Liabilities represent what the company owes to others, including loans, accounts payable, and any debts due within a year (current liabilities) or beyond a year (long-term liabilities).

- Equity, also known as shareholders’ equity, is the amount of money that would be returned to shareholders if all the company’s assets were liquidated and all its debt was paid off.

The three components are also part of the accounting equation:

Assets = Liabilities + Equity

The equation helps explain the statement’s name, and each side needs to be balanced. Investors need to understand how each side of the equation works and what it means to each company.

Always remember that a balance sheet indicates a moment in time. It is a snapshot of the financial position that day. The other statements, income and cash flow, are accrual methods, indicating activity over 90 days.

With this foundation, we can analyze Amazon’s balance sheet using key financial ratios, highlighting various aspects of its financial health.

These ratios, from liquidity and solvency ratios to efficiency and profitability metrics, provide a comprehensive view of Amazon’s financial position.

Let’s examine how financial ratios are applied in analyzing a balance sheet and their significance in evaluating a company’s performance.

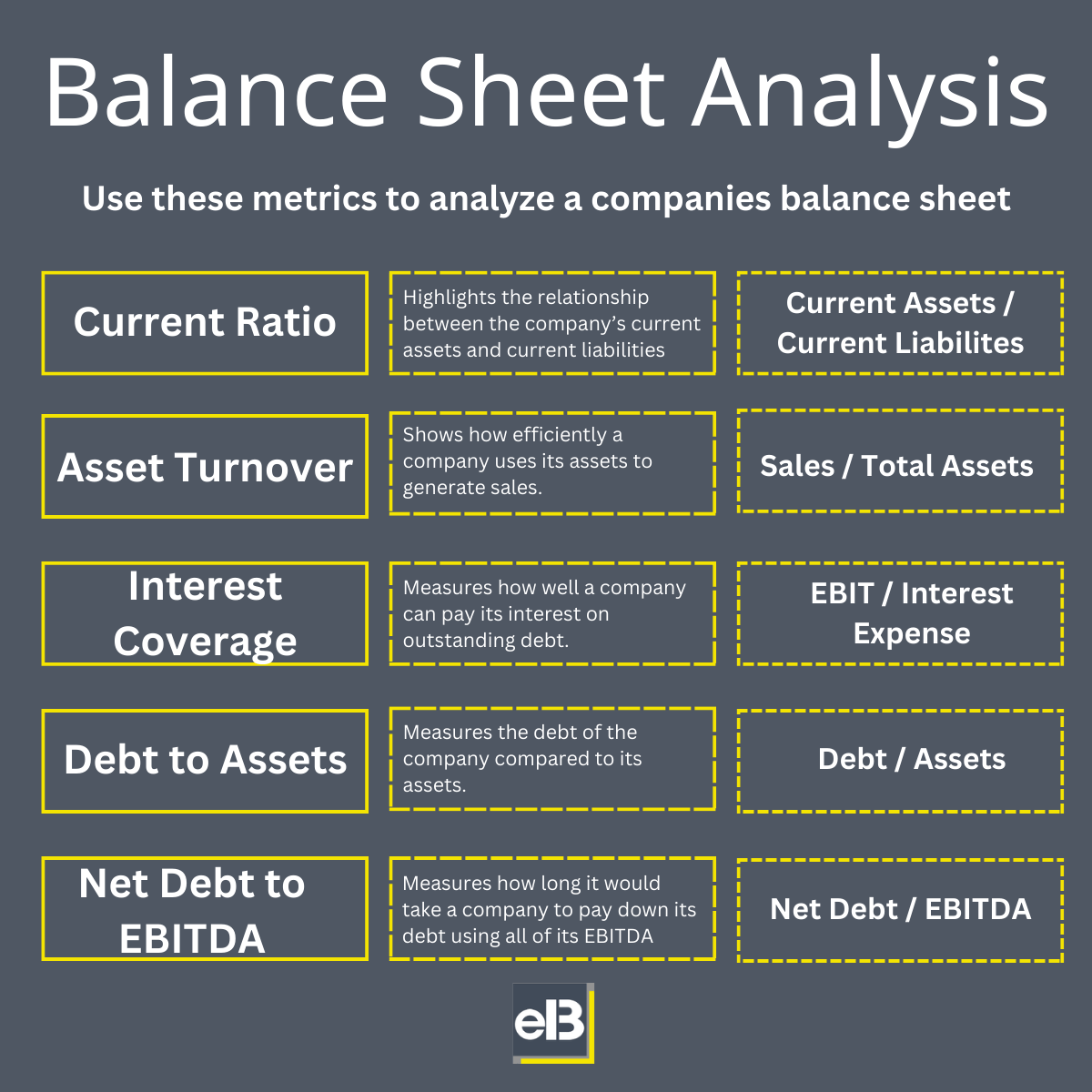

The Importance of Financial Ratios for Analyzing a Balance Sheet

Financial ratios serve as a magnifying glass, offering detailed insights into various aspects of a company’s financial health that the raw figures on a balance sheet might not reveal at first glance.

These ratios analyze a company’s operational efficiency, liquidity, solvency, and profitability by comparing different line items from the balance sheet, income statement, and cash flow statement.

Financial ratios provide stakeholders, such as investors, creditors, and management, with a quantifiable way of assessing a company’s performance and financial condition over time or compared to industry peers.

Why Financial Ratios Matter

- Liquidity Ratios (like the Current Ratio and Quick Ratio) measure a company’s ability to cover its short-term obligations with its short-term assets. This is crucial for assessing how well a company can withstand financial distress or unexpected expenses.

- Solvency Ratios (such as debt-to-assets and Debt-to-Equity Ratios) examine the extent of a company’s reliance on debt financing, offering insights into its long-term financial stability and risk.

- Efficiency Ratios (including Asset Turnover and Inventory Turnover) highlight how effectively a company uses its assets to generate sales, which indicates operational performance.

- Profitability Ratios reflect a company’s ability to generate earnings relative to its revenue, equity, and assets. These ratios are vital for evaluating the company’s financial viability and growth potential.

Each ratio tells a part of the company’s financial story, and when combined, they provide a comprehensive view of the company’s financial health.

Analyzing Amazon’s Financial Health

As we dive into Amazon’s balance sheet to calculate and interpret these key financial ratios, we aim to uncover insights into its liquidity, solvency, efficiency, and profitability.

With its vast operations in e-commerce, cloud computing, and other areas, Amazon presents a fascinating case study for financial analysis.

The following sections will guide you through the calculations of ten essential financial ratios for Amazon. We will explore what each ratio indicates about Amazon’s financial health and how it benchmarks against industry standards or over time.

Case Study: Analyzing Amazon’s Balance Sheet with 10 Metrics

Here is the list of metrics we will use:

- Working Capital

- Current Ratio

- Quick Ratio

- Interest Coverage Ratio

- Debt-to-Assets

- Debt-to-Equity

- Asset Turnover

- Days Sales Outstanding

- Inventory Turnover

- Net Debt to Free Cash Flow

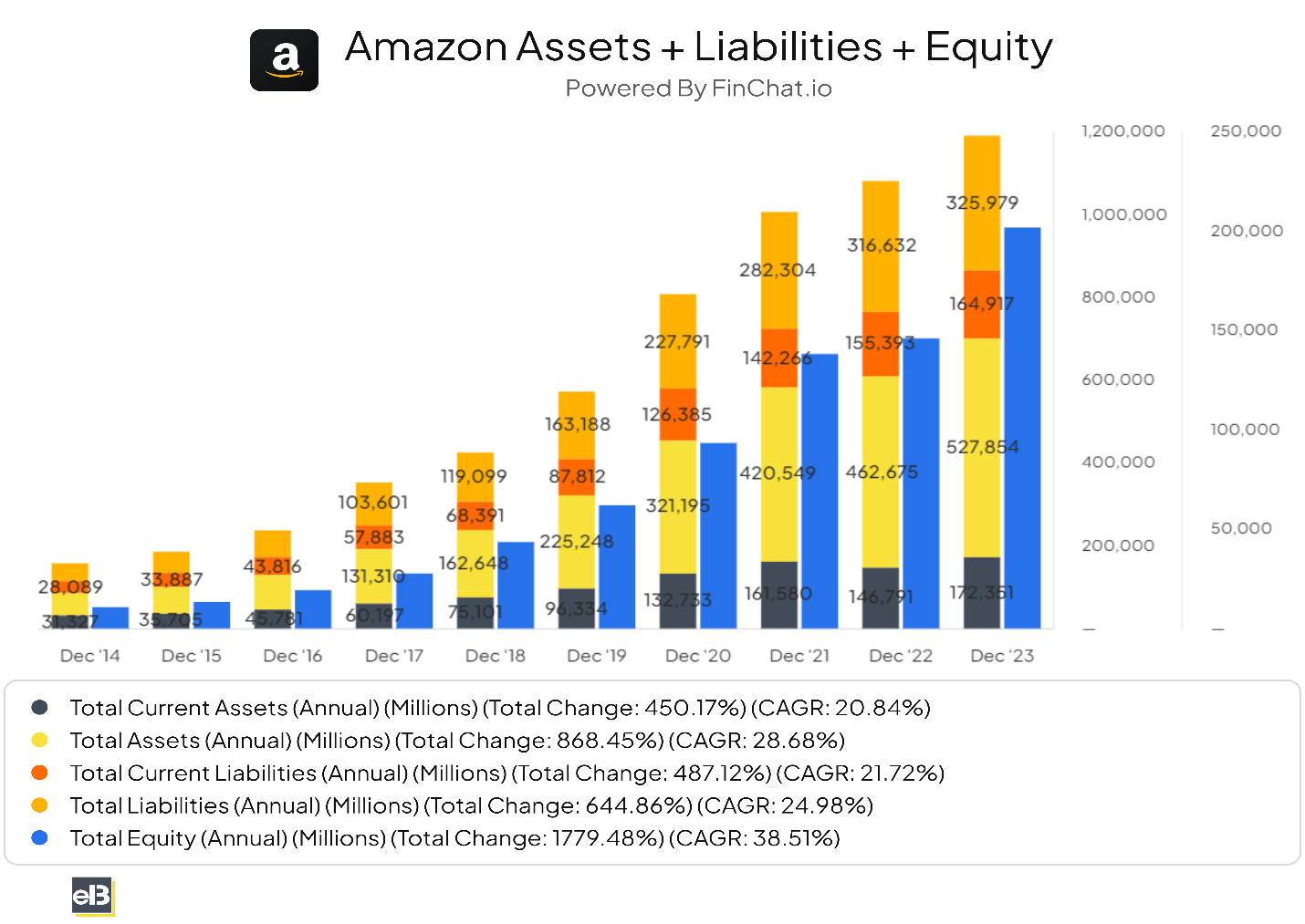

Working Capital Analysis of Amazon

Working capital is a key financial metric that measures a company’s ability to pay off its current liabilities with its current assets. It’s an important indicator of the company’s short-term financial health and liquidity.

The formula to calculate working capital is:

Working Capital = Current Assets – Current Liabilities

To calculate Amazon’s working capital, we would use its balance sheet to find the total current assets and subtract the total current liabilities. Thus:

Working Capital for Amazon = $172.3 billion – $164.9 billion = $7.4 billion

Interpretation

A positive working capital indicates that Amazon can cover its short-term liabilities with its short-term assets, suggesting good short-term financial health.

This means that Amazon has enough liquidity to fund its day-to-day operations, invest in growth opportunities, and handle unexpected expenses or economic downturns. However, excessively high working capital might suggest that Amazon is not efficiently using its assets to grow its business.

Current Ratio: A Liquidity Indicator for Amazon

The current ratio, another liquidity ratio, compares a company’s current assets to its current liabilities. It provides insight into the company’s ability to repay its short-term obligations with its assets. The formula is:

Current Ratio = Current Assets / Current Liabilities

Using the same figures as above, Amazon’s current ratio would be calculated as follows:

Current Ratio for Amazon = $172.3 billion / $164.9 billion = 1.04

Interpretation

A current ratio 1.04 means that Amazon has $1.04 in current assets for every dollar of current liabilities.

Generally, a current ratio between 1.0 and 2.0 is considered healthy. Amazon’s ratio suggests it is in a stable liquidity position, capable of covering its short-term obligations without financial stress. However, ratios far above or below this range might indicate liquidity management issues or an inefficient use of resources.

Quick Ratio: Assessing Amazon’s Immediate Solvency

The quick ratio, or acid-test ratio, takes the current ratio analysis further by measuring a company’s ability to meet its short-term obligations with its most liquid assets.

It excludes inventory from current assets, as inventory is not as easily converted into cash. The formula is:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Amazon’s inventory is valued at $33.3 billion; the quick ratio would be calculated as follows:

Quick Ratio for Amazon = ($172.3 billion – $33.3 billion) / $164.9 billion = 0.84

Interpretation

A quick ratio of 1 indicates that Amazon can cover its current liabilities exactly without relying on the sale of inventory.

This signifies a strong position, as it shows the company can meet its short-term liabilities immediately without liquidating its inventory. A quick ratio above 1 is preferable, as it indicates greater liquidity and financial health.

Interest Coverage Ratio: Amazon’s Debt Servicing Ability

The interest coverage ratio is a solvency ratio that measures a company’s ability to handle its debt obligations by comparing its earnings before interest and taxes (EBIT) to its interest expenses.

This ratio indicates how often a company can cover its interest payments with earnings. It’s a crucial metric for assessing a company’s financial stability and risk of default.

The formula is:

Interest Coverage Ratio = EBIT / Interest Expenses

Amazon’s annual EBIT is $36.8 billion, and its interest expenses are $3.1 billion. Therefore:

Interest Coverage Ratio for Amazon = $36.8 billion / $3.1 billion = 11.9

Interpretation

An interest coverage ratio of 11.9 means Amazon can cover its interest expenses almost 12 times over with its earnings.

Generally, a ratio above 1.5 is considered satisfactory, indicating that the company earns enough to cover its interest payments comfortably. Amazon’s ratio of 11.9 suggests strong financial health and a low risk of default on its debt obligations.

Debt to Assets Ratio: Understanding Amazon’s Leverage

The debt-to-assets ratio measures the proportion of a company’s debt-financed assets. It gives investors and analysts an idea of the company’s financial leverage and risk level. The formula is:

Debt to Assets Ratio = Total Liabilities / Total Assets

Amazon’s total debt is $161.6 billion, and its total assets are $527.8 billion:

Debt to Assets Ratio for Amazon = $161.6 billion / $527.8 billion = 0.31

Interpretation

A debt-to-assets ratio of 0.31 means that 31% of Amazon’s assets are financed through debt.

Ratios below 1 indicate that a company has more assets than liabilities, which is generally positive. However, the desirability of the ratio depends on the industry standards and the company’s growth stage. Amazon’s ratio suggests a balanced approach to leveraging, with a healthy mix of debt and equity financing.

Debt to Equity Ratio: Evaluating Amazon’s Financial Structure

The debt-to-equity ratio provides insight into a company’s financial structure by comparing its total liabilities to its shareholders’ equity. It measures the degree to which a company finances its operations through debt rather than wholly owned funds.

The formula is:

Debt to Equity Ratio = Total Liabilities / Shareholders’ Equity

Amazon’s shareholders’ equity equals $201.8 billion:

Debt to Equity Ratio for Amazon = $161.6 billion / $201.8 billion = 0.80

Interpretation

A debt-to-equity ratio of 0.80 means that Amazon has lower debt than equity. This ratio varies greatly across industries, but a ratio of 1 or below generally indicates a balanced capital structure. It suggests that Amazon relies equally on debt and equity to finance its assets, which can be seen as a balanced risk approach.

Asset Turnover Ratio: Measuring Amazon’s Efficiency

The Asset Turnover Ratio measures how efficiently a company uses its assets to generate sales. It is a key indicator of operational efficiency, showing how well a company converts its assets into revenue.

The formula for calculating the asset turnover ratio is:

Asset Turnover Ratio = Net Sales / Average Total Assets

Amazon’s net sales for the year are $574.7 billion, and its average total assets are $477.2 billion:

Asset Turnover Ratio for Amazon = $574.7 billion / $477.2 billion = 1.20

Interpretation

An asset turnover ratio 1.20 suggests that Amazon generates $1.20 in sales for every dollar in assets. This ratio varies by industry, but for a company operating in the e-commerce and technology sectors, this indicates a strong performance, showcasing Amazon’s ability to use its asset base to generate revenue efficiently.

Days Sales Outstanding (DSO): Analyzing Amazon’s Receivables

Days Sales Outstanding (DSO) measures a company’s average days to collect payment after a sale. It’s a useful indicator of the efficiency of a company’s collections and credit policies.

The formula to calculate DSO is:

DSO = (Average Accounts Receivable / Sales) * Days

Amazon’s average accounts receivable is $46.3 billion, and its sales are $574.7 billion. Using 365 days for a year:

DSO for Amazon = ($46.3 billion / $574.7 billion) * 365 = 29.4 days

Interpretation

A DSO of approximately 29 days indicates that Amazon can quickly convert its receivables into cash. This collection efficiency is crucial for maintaining liquidity and supporting continuous investment and operational needs.

Inventory Turnover: Understanding Amazon’s Inventory Management

Inventory Turnover is a ratio showing how many times a company’s inventory is sold and replaced over a period. It measures the efficiency of inventory management and the effectiveness of sales and production processes.

The formula is:

Inventory Turnover = Cost of Goods Sold / Average Inventory

Amazon’s cost of goods sold (COGS) for the year is $304.7 billion, and its average inventory is $33.3 billion:

Inventory Turnover for Amazon = $304.7 billion / $33.3 billion = 9.1

Interpretation

An inventory turnover ratio of 9.1 indicates that Amazon sells and replaces its inventory 9.1 times yearly. This high turnover rate indicates efficient inventory management and strong sales, ensuring that capital is not tied up in unsold inventory and aligning with Amazon’s fast-moving business model.

Net Debt to Free Cash Flow: Assessing Amazon’s Financial Flexibility

Net Debt to Free Cash Flow is a ratio that compares a company’s total debt minus cash and cash equivalents to its free cash flow. It assesses the company’s ability to cover its debt with the cash flow left after operational expenses and capital expenditures.

The formula is:

Net Debt to Free Cash Flow = (Total Debt – Cash and Cash Equivalents) / Free Cash Flow

Amazon’s total debt is $161.5 billion, cash and cash equivalents are $86.7 billion, and its free cash flow is $32.2 billion:

Net Debt to Free Cash Flow for Amazon = ($161.5 billion – $86.7 billion) / $32.2 billion = 2.32

Interpretation

A Net Debt to Free Cash Flow ratio of 2.32 means Amazon can cover its net debt with more than two years of free cash flow, indicating strong financial flexibility. This suggests that Amazon is well-positioned to pay down its debt, invest in growth opportunities, or return value to shareholders.

Investor Takeaway

Today, we used ten financial ratios to measure Amazon’s operating efficiency, liquidity, and solvency.

Through working capital, current ratio, and quick ratio calculations, we’ve seen how Amazon stands in terms of short-term financial health. These metrics confirmed Amazon’s ability to meet its immediate obligations, showcasing strong liquidity. The interest coverage, debt to assets, and debt to equity ratios highlighted Amazon’s solid financial structure and low risk of default, illustrating its long-term financial stability.

Additionally, efficiency ratios like asset turnover, days sales outstanding, and inventory turnover shed light on Amazon’s operational effectiveness, demonstrating its prowess in utilizing assets and managing inventory.

Lastly, the net debt to free cash flow ratio underscored Amazon’s financial flexibility and ability to handle debt with its operational cash flow.

As we’ve navigated through these financial indicators, it’s clear that Amazon’s financial health is strong, underpinning its leadership position in the e-commerce and tech industry.

For those looking to deepen their understanding of financial analysis, a natural next step would be to explore how these ratios compare across different industries and companies.

With that, we will wrap up our discussion of the 10 metrics we can use to analyze a company’s balance sheet.

Thank you for reading today’s post, and I hope you found something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Beginner’s Guide to Total Current Assets You can use total current assets to assess a company’s financial standing. Today’s post will teach us the formulas to use and what to do...

- Unlocking Financial Insights: How the 3 Key Financial Statements Interconnect “Accounting is the language of business.” Warren Buffett This brief quote underscores Buffett’s belief that a deep understanding of financials and accounting remains essential for...

- From Investments to Cash: Decoding the Cash Conversion Ratio Cash conversion is a key concept in investing. It helps investors determine how effective they are at translating earnings into cash. It also helps us...

- What are Cost of Goods Sold and What’s Included in it? Controlling costs remains one of the more important jobs of management. They must control the costs of producing revenues, which reflect their profits. One of...