In today’s world, it can seem very overwhelming to find the perfect brokerage company to begin your investing journey with. Not only am I going to give you a comprehensive look of the many investment company names that you have to choose from, but I will rank them based on my experience and 3rd party reviews so you can make the best decision for yourself!

At the end of the day, I think that the various investment companies that you can choose are all similar. Sure, some of them do have some advantages over one another, but at the end of the day, you’re really choosing from a commodity-driven business (in my eyes).

Naturally, I think it makes sense for us start off with some of the “Millennial” investment companies, so Robinhood will start us off.

Personally, I think that Robinhood has somewhat been made a bit of a scapegoat for people when they want to get mad about investing. They were the poster boy during the GameStop craze but they really didn’t do anything different than what other brokerage firms were also having to do.

They also get a ton of flack about making money off of the buy/sell spreads when you execute trades, but let’s not forget that they were the ones to really force all other brokerages to offer $0 commission trades, so yes – they have to make money somehow. And if you really hate this, you can eliminate it by using a limit buy and limit sell.

Now don’t get me wrong, I personally have a vendetta with Robinhood and do think there are much better alternatives out there. Robinhood completely crashed for an entire day for me and that day I withdrew all my funds. As with any small company, and not that they’re “small” but they are compared to other brokerages, they’re going to have growing pains. It’s just a natural part of the process.

For Robinhood, the two main benefits of using them was their platform was very user-friendly and they offered $0 commission trades. Well, with almost all other brokerages offering $0 commission trades, that benefit is now gone.

And truthfully, the platform doesn’t matter that much unless you’re in it frequently and buying/selling throughout the day, which I am not. I am in it for the long-term and while I do like to track my investments daily, I am not making buy/sell decisions daily so I will use an app like Yahoo Finance that has a great platform.

Now I will say that if you’re using margin, the rates are much lower on Robinhood than many other brokerages (by like 5%+) but that’s a double-edged sword. Another personal riff with me is how easy they allow people to be approved by margin, and that’s something that has turned me away from them.

Probably the most important aspect is that Robinhood doesn’t have an IRA option, and I recommend that any investor maxes that out each year ($6K in 2021) prior to putting any money into a brokerage account. For that reason alone, I would pass on Robinhood.

But if you’ve maxed out your IRA, want to use margin and enjoy the sleek platform, it might be a great option for you – just go into it with eyes wide open that there are going to be growing pains and things will frustrate you as we have seen multiple times throughout 2020 and 2021 when they have encountered higher-than-normal traffic on their platform.

Another similar option to Robinhood in the Millennial investing community is a brokerage called Webull.

I have not personally used Webull before but know friends that have, and they’ve had conflicting opinions on their experiences. In short, Webull is great for someone that knows exactly what they’re doing and is simply looking for a great broker to get them there.

The educational tools, which I think are extremely important, are effectively nonexistent. You’ll see that as we get further into these comparisons of the various investment companies, the more established the companies are, the more support that you’re going to have as an investor. Of course, there are going to be some “downsides” as well, but that’s the nature of the beast.

Webull has advanced charts and technical information that make it a great platform if you’re an active trader looking for low-cost fees, but if you’re a long-term investor like we are at Investing for Beginners, Webull might not be for you.

One major advantage that Webull does have is that they give you access to purchase cryptocurrency which some of the larger brokers do not offer. Personally, this makes no difference to me as I do not currently and do not have a desire to invest in the future in crypto, but I understand those that do want to do so as a form of diversification.

Note that I said diversification…don’t get overconcentrated in a currency that can be outlawed by your government at the snap of their fingers. It should be viewed the same way that I view all my speculative investments and nothing more.

Webull also provides very low-interest rates for your margin investing if that’s something that you’re looking for which I have written about previously – high risk, high reward.

At the end of the day, if you’re a long-term investor or one that’s new to the investing world, I think you have better options than Webull. If you’re truly a “trader” that is looking to get in and out of stocks frequently throughout the course of day, Webull might be a great fit for you.

I don’t have the appetite to do that and for those reasons, I’m out!

The next broker that I want to talk about is one that you have likely heard of in TD Ameritrade.

Most of the benefits of Robinhood and Webull are not available with TD Ameritrade, but on the flip side, they excel in those broker’s weaknesses. What exactly do I mean?

Well, TD Ameritrade has great customer service and research tools that you can use to educate yourself in your investing journey. As I’ve mentioned before, I think this is imperative as a new or long-term investor to make sure that you’re really building up your foundational knowledge before investing your money and losing at all.

On the other hand, TD Ameritrade doesn’t offer crypto investing and they have much higher margin interest rates. As noted by the Motley Fool, their margin rates are:

- Under $10,000 margin balance: 9.50%

- $10,000 to $24,999 margin balance: 9.25%

- $25,000 to $49,999 margin balance: 9.00%

- $50,000 to $99,999 margin balance: 8.00%

- $100,000 to $249,999 margin balance: 7.75%

- $250,000 to $499,999 margin balance: 7.50%

That is a HUGE increase over the Robinhood rates which are down in the 3-4% range. That’s quite literally the difference between feeling comfortable using margin to simply invest in SPY and not being able to do so.

With the S&P averaging about 10% annually, I might be willing to use margin to invest ta a 3% interest rate. At 9%? No way. Not even close to being worth the risk.

TD Ameritrade also will give you access to many investment vehicles like an IRA which I mentioned previously and honestly, that in itself is a reason to consider them.

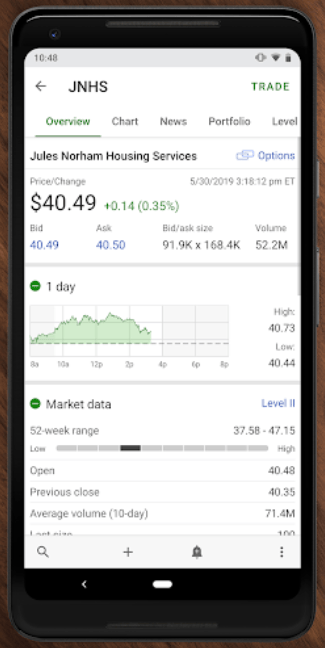

The one thing that I was really surprised to learn about TD Ameritrade is that their app is very sleek and easy to use. You can see below that it’s not too clunky at all and everything is laid out in a nice, easy-to-digest fashion:

I think we’re getting much closer to having a broker that I would recommend using. In fact, if you’re one that uses your mobile application to do a lot of investing, I think that TD Ameritrade would be a fantastic option for you. They have that perfect blend of “old” and “new” brokerages that gives you the customer service, educational support and investing tools to get you where you want to be but also blending it with a modern app.

The next broker that I want to discuss is Charles Schwab.

Charles Schwab really appears to be a jack of all trades but a master of none. They do a great job at being “above average” in many different aspects but they don’t appear to be that primo, #1 contender in really any category. For this, I think that Charles Schwab is a great option for someone that is looking to grow and develop within their brokerage.

They have an above average app, educational help, $0 commission trades and have a plethora of ETFs and a great ETF screener to go along with it.

Dave and Andrew are not as into ETFs as I am, but I really like to use them to gain exposure to a new market category or segment, or even just as a place to park my money while I am looking for individual companies to invest in. I think ETFs are great diversification tools, so the fact that Charles Schwab offers a robust screener with many options is something that I am very intrigued in!

Overall, Investopedia graded them as a 4/5 which falls right in the same range as TD Ameritrade ratings that I have seen.

Personally, I would prefer to work with a brokerage firm that is going to be a “master” in the stage that I am currently at and then move to a different brokerage firm as my needs change. For this reason, using Schwab to stay with throughout my investing journey isn’t something that I would personally do.

I have switched brokerages before, and the process was extremely easy. Just tell the new company that you want to move your current money and if they’re good, they’ll handle the rest. I mean, after all, they WANT your money in their accounts, so they’re motivated to do it.

If you’re keeping score at this point, I am leaning towards TD Ameritrade as my favorite…but we have one more!

And that brings us to Fidelity.

Fidelity is a brokerage firm that I have used for many years, ever since I graduated college and my 401k with my employer was there, so I have vast experience with them.

For probably 4-5 years of this 7-year period, I thought they were just “eh”. Their website was a bit clunky and it was hard to understand how to do things for the new investor. Truthfully, I think that some of this turned me off from investing on my own early on in my career. But they do quite a few things right as well!

They have a vast product offering for different account types and you can setup a new account, even an IRA, in less than 5 minutes. I mean literally less than 5 minutes and then you can add funds and start purchasing stocks. That is huge for me to not have to jump through all the hoops to add a new account.

Personally, I like to separate my accounts into different goals that I have so I really, really like this feature.

Also, their customer service is primo. I have received great assistance into the mechanics of how things work. Such as, “if I were to take out a 401k loan, how would that work?” or “what is the process to be approved for options?”

On the other hand, asking them tax advice is something I would shy away from, as you really should with any brokerage firm. I once asked them about my pension options if I could leave my employer and they said I “only have to pay taxes” but that is not true at all. I confirmed with one of my friends that is a CFP and he said that I absolutely must pay early withdrawal penalties, as I assumed, so their advice would’ve really misguided someone that didn’t take that extra step to doublecheck. That’s why you just leave your pension where it is or put it in an IRA!

They also allow you to trade individual stocks within your HSA which is something that is HUGE to me! The HSA is the #1 thing that I contribute to after maxing out my 401k employer match because of its triple tax-advantage. Being able to put those funds into any stock or ETF is something that not all brokerages offer.

They also have a ton of educational options that can help you simply learn about different investments. They have many investment reports as well that are put out by various analysts so you can read a couple pages and see their opinion. Now, that’s not part of my stock picking process, but I do like to see what others say as an intro into certain companies.

Their margin rates do tend to be very, very high, right in the range of TD Ameritrade, and you also cannot trade crypto with them. Both are not huge drawbacks to me, but I know that they certainly may be for others. I have a friend that has his “normal” investments in Fidelity and then he uses margin and owns crypto in a Robinhood account. Personally, my OCD of two different brokerages will singlehandedly keep me from doing that…

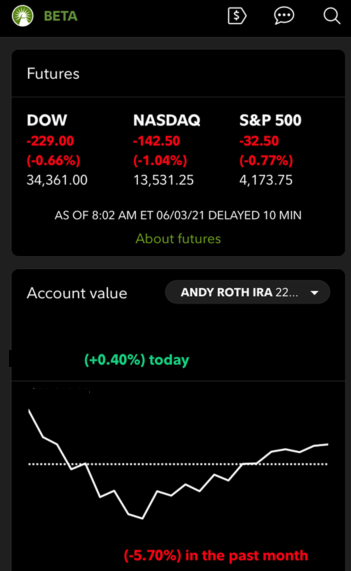

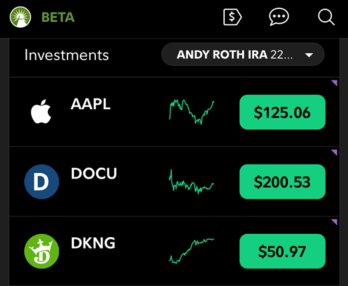

The one major downside of Fidelity, to me, is that their mobile app is very clunky. They’re doing some Beta testing on a new app that current users can try and honestly, it looks pretty like Robinhood…

I blurred out some of the share amounts and balance information in those screenshots, but you can see how sleek the app is being made. I really, really like it and will be curious to see how they complete the entire rollout.

Summary

In summary, I think that Fidelity wins in a landslide. The only downsides are their margin rates and that they don’t offer crypto and if those are imperative to you, then we simply have a different mindset on investing and maybe a different brokerage firm is better for you.

There are so many different brokerage firms because everyone has different needs. For me, the buy and hold, long-term investor that is looking for value, both in “value” stocks and also in “growth” stocks, Fidelity is the easy winner.

But don’t just take it from me – play around with them a little bit and maybe try to open a couple and just see how the platform works. But whatever you do – make sure you’re opening an IRA. It would be a shame to pay the taxman even more dollars than we’re required to!

Related posts:

- I’m Ready to Invest – How Do I Know What Stocks to Buy? So, I’ve finally been able to sell you on the concept of how compound interest can literally change lives and now you’re wondering how to...

- Having Investing Paralysis by Analysis? Start with a SWOT Matrix! If you have ever had to create a SWOT Matrix for a school project then I am guessing that you are probably triggered by even...

- How to Find the ADR Dividend Tax Policy of a Company in Minutes An ADR, or American Depositary Receipt, is a simple type of share that allows U.S. investors to invest in companies headquartered outside the U.S. But...

- Ally Brokerage Basics: A Guide for Beginners A common first step for any potential investor is to try to find out what brokerage is the best for them to open their account...