Newsflash—even profitable companies can suddenly go bankrupt. Unlike many of the 2009 bankruptcies, Monaco did not have much debt on its balance sheet.

It was a sudden credit crunch and a tough environment which led to their demise.

In this post, we will break down perhaps the most shocking bankruptcy from 2009, and its grueling lessons:

- When Financial Metrics Break Down

- How the Great Financial Crisis Indirectly Affected Business

- A Deep Dive into the Annual Report

- A Deeper Look into the Footnotes

- Investor Takeaway

When Financial Metrics Break Down

Most analysts and investors focus on a company’s consolidated financials when it comes to evaluating the risk of a business. This makes sense because nobody in the world has time to read every word of every single annual report, at least not in any given year.

We need shortcuts to help us filter out bad companies quickly, which is why there are great risk evaluation formulas such as:

However, just because a company scores great in all of the standard risk measurements doesn’t mean that the company is safe. Any company can be wiped out with what Nassim Taleb called a “black swan event,” which are unprecedented changes in our very random world which don’t follow historical norms.

We’ll see very soon how a low historical default rate led Monaco to take on huge downside risk—which didn’t seem risky at the time because such an economic collapse hadn’t happened before.

This is a reason why conservative leaders of companies such as Berkshire Hathaway’s Warren Buffett like to keep cash on the balance sheet, and limit their obligations.

Sometimes it is better to be safe than sorry, and as we’ll see with this 2009 bankruptcy feature, Monaco and its 5,000+ employees were themselves affected by their own black swan—the Great Financial Crisis.

How the Great Financial Crisis Indirectly Affected Business

Firstly, Monaco Coach was not one of the traditional big bank stories who collapsed from an extremely leveraged balance sheet, such as Lehman Brothers.

They weren’t even in the banking business; the company sold RVs.

Of course, RVs (recreational vehicles) are a cyclical business—meaning that they do well when the economy is strong and people have disposable income, and they struggle when there is a cyclical downturn.

But, just because a company is a cyclical business doesn’t mean they are bound for bankruptcy with every economic slowdown. Economies slow down all of the time, and cyclical business leaders know this.

To combat this, many cyclical companies will limit their debt exposure, and leave enough cash on the balance sheet to pay on these debts.

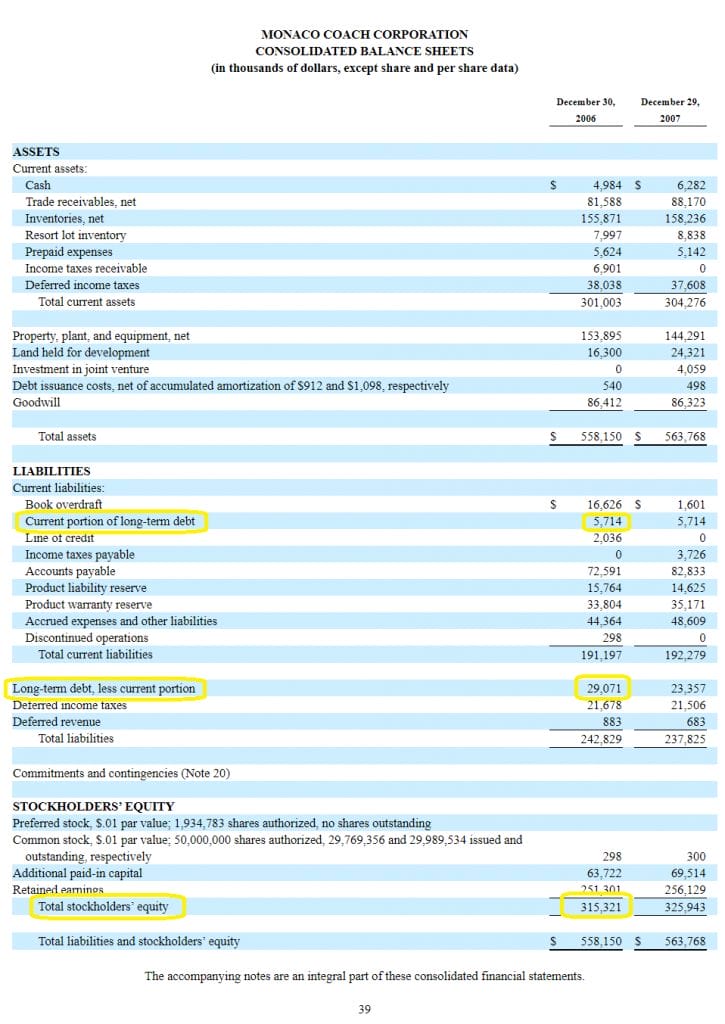

Monaco was no exception; here’s their debt picture from their consolidated balance sheet on the last 10-K publicly filed before bankruptcy:

The three highlights I made represent the difference between what the company owes and what they own.

Using those three numbers you can calculate the company’s Debt to Equity Ratio, which is a standard risk metric used on Wall Street:

Debt to Equity = (Short Term Debt + Long Term Debt) / Shareholder’s Equity

For Monaco, with those numbers they scored:

= (5,714 + 29,071) / 315,321

= 0.11

Generally, anything below 1 means a company is in pretty good shape. Monaco’s 0.11 is extremely low, so to the unsuspecting investor it looks like a basically no-risk proposition.

Another formula that’s commonly used, and one I particularly like to examine, is the interest coverage ratio. Basically this tells us how easily a company can make the interest payments on its debt.

You just have to pull two numbers from Monaco’s Income Statement to calculate this:

- Operating Income = $7,221 million

- Interest Expense = $1,820 million

- Coverage ratio = Operating Income / Interest Expense

- 7,221 / 1,820 = 3.97x

Generally, a coverage ratio of at least 2.0x is at least acceptable, and Monaco’s 3.97x is actually pretty healthy.

So again, you have a situation where the company appears to be safe with the surface level look.

Unfortunately the devil is in the details.

A Deep Dive into Monaco Coach’s Last Annual Report (2008)

To understand Monaco’s business and financial condition, we have to read through their last 10-K (annual report), filed on March 2008.

It’s 79 pages, which for a 10-K isn’t that bad, but can be a daunting challenge for the average investor who feels they don’t have the expertise to understand it all. This is why Dave made an entire guide on how to dissect the 10-K, and I highly recommend reading that as well. It’s another valuable skill to have as an investor.

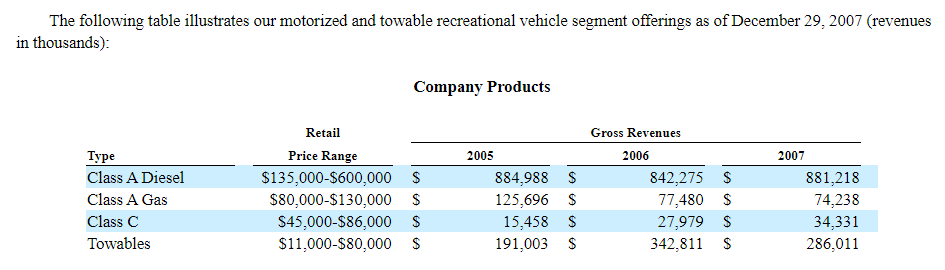

We can quickly gather that the company primarily sells RVs, and within the first few pages they report their revenue figures from each of their three main business segments:

- Motorized recreational vehicle segment

- Towable recreational vehicle segment

- Motorhome resort segment

They also nicely illustrate their products, with gross revenues sourced from each:

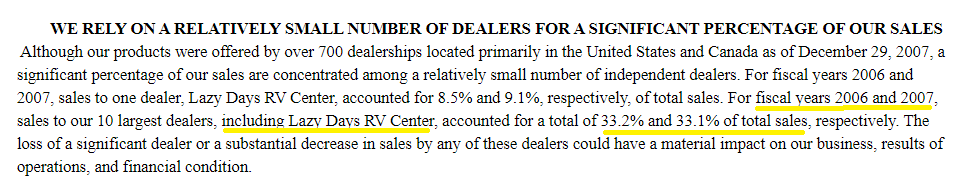

Moving on to the Risk Factors section of the annual report, we can glean a couple of “red flags” which the investor working like a detective can sniff out:

If we really think through the ramifications of that sentence, what the company is saying is that if that one single dealer, Lazy Days RV Center, goes bankrupt—there goes around 33% of their revenues.

That may or may not be catastrophic, but that would represent a huge haircut.

I’ll admit that if I read this one through without any context, it would not ring alarm bells in my head. We’ll see later that there are other ways to sniff out red flags that should bring us back to this Risk Factor, as we realize there’s actually pretty substantial (black swan) risk here:

We could continue down the Risk Factors, which I recommend you read through entirely on any company you are interested in buying for the long term, but for our purposes let’s move on to do some more important detective work.

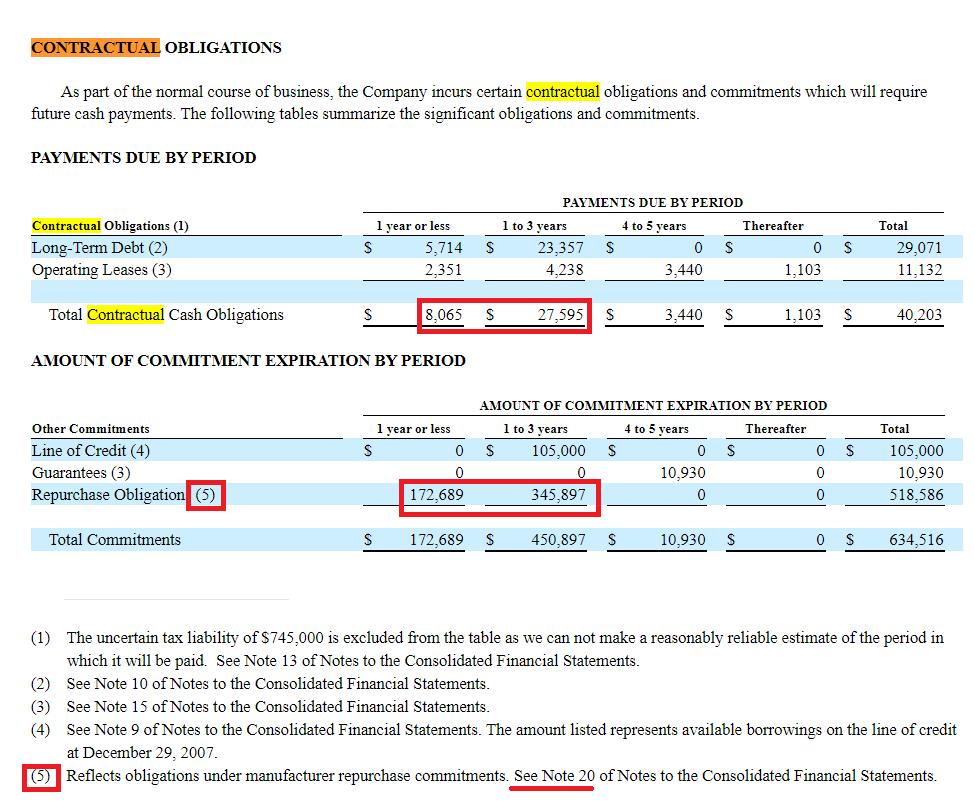

I always like to look at what a company owes soon; this is usually found in a section in the 10-K called “Contractual Obligations,” or something close to that.

If you’re really wanting to get in the weeds on that topic, I wrote an entire guide on evaluating Contractual Obligations for you “inside baseball” folks out there.

A few notes on the significant implications of this screenshot…

First, let’s get context on the gravity of those numbers. We know from earlier in the 10-K that these are numbers in the thousands, and so we’re looking at contractual obligations of $8,065 and $27,595 thousand ($8 million and $27.6 million), and commitments of $172.7 and $450.9 million.

We’ll go back to the consolidated financial statements (income statement, balance sheet, and cash flow statement) to see if that’s a lot, or not.

Looking at 2007 figures, the company recorded $1.27 billion in sales. That sounds like a lot, but of course you have many expenses in running a business as well.

Profit (net income) clocked in at $12 million, with Cash from operating activities at $34.8 million. The $34.8 million gives us a pretty good picture of cash flowing in and out of the business due to its core operations (selling RVs), while other parts of the cash flow statement will include larger company functions like taking out or paying debt, making buybacks, etc.

So generally, the company looks to have plenty of runway to at least pay their contractual obligations, which includes the debt principal that is due and must be paid no matter what.

Note that companies can (and often do) refinance their debts, so principal payments don’t necessarily represent cash that needs to come out of operations. But… financial crises like what happened in 2008/2009 can make it very hard to take out debt, but for Monaco there seemed to be something else that could’ve taken them out.

A Deeper Look into the Footnotes

Going back to the screenshot above, remember how commitments were $172.7 and $450.9 million for the next several years. As we’ll see below, commitments are different than obligations because they are not necessarily required—the company is potentially on the hook, but most of the time this hasn’t been a problem.

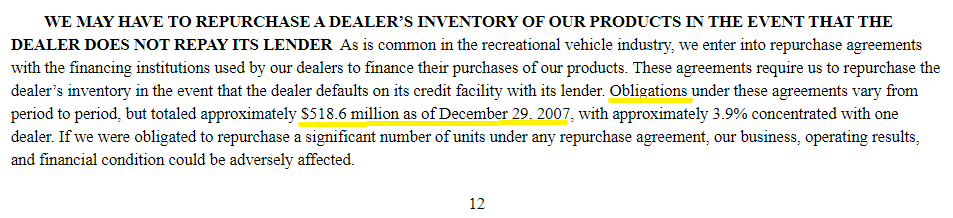

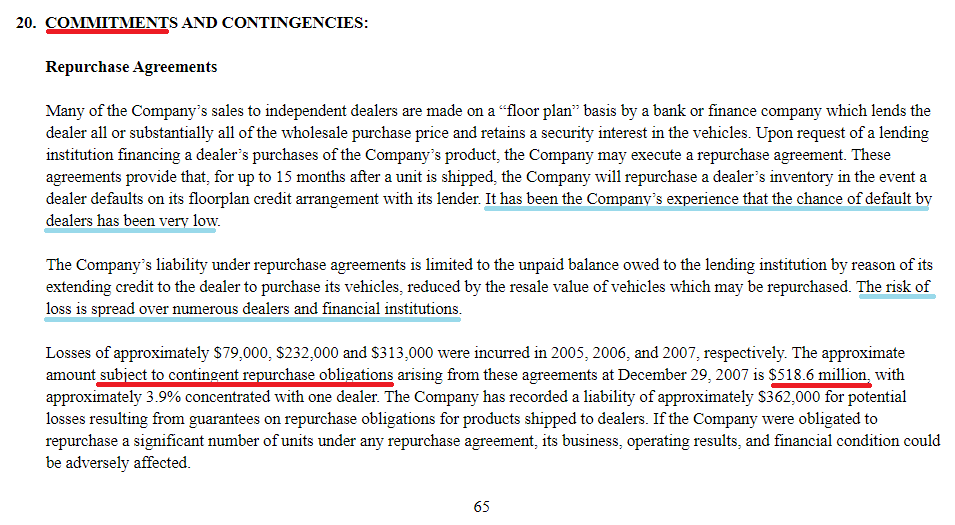

Going to Note 20 to learn more about their commitments (as the company referenced by the [5] in the screenshot):

This is a bit of a mouthful to translate, but we see that same $518.6 million figure that we saw in the Risk Factors screenshot above.

It’s in the same ballpark as the upcoming commitments in our Contractual Obligations table, so we know we’re in the right spot.

Don’t worry about the numbers not adding up, the $518.6 million is backwards looking while the others above are forward looking (and in general, sometimes annual reports don’t add up exactly because there tends to be lots of moving pieces). Be approximately right instead of precisely wrong.

Just like I mentioned before, these repurchase agreements represent a liability to Monaco only if, as quoted in the note: “in the event a dealer defaults on its floorplan credit arrangement with its lender.”

However, the company doesn’t seem to see extraordinary risks with these potential liabilities, because as I highlighted in blue they state:

“it has been the company’s experience that the chance of default by dealers has been very low.”

And,

“The risk of loss is spread over numerous dealers and financial institutions.”

This is a classic case of the pitfalls of a black swan as taught by Taleb. While diversification can help the company in this case against any single dealer defaulting, the diversification doesn’t help in the case of “systemic risk,” which is one where the entire system shuts down.

A complete collapse of dealers and financial institutions had not been seen in a very long time in the U.S. economy, and so this risk appeared to be nil.

And that’s what makes a black swan so devasting. Because it’s often so unprecedented.

In hindsight, we know exactly what happened during the Great Financial Crisis. Banks were too easy on lending, giving out subprime loans for mortgages and auto loans like candy, and it worked brilliantly until it all collapsed like a house of cards.

But at the end of the day, it was not these outside balance sheet exposures but rather an inability to quickly raise capital which did the company in, as revealed in the 8-K bankruptcy announcement:

“Over the past 20 months, the Company has taken aggressive steps to improve the absorption of indirect expenses and to reduce material and labor costs. Despite these drastic efforts, a variety of factors has combined to prevent the Company from generating the necessary liquidity or obtaining the additional financing to operate outside bankruptcy protection. The economic climate has deteriorated considerably since the Company entered into its current financing arrangements announced on November 6, 2008, and the national and global credit markets have continued to tighten.”

On March 5, 2009, Monaco declared bankruptcy, leaving shareholders with permanent losses.

Go back to the Consolidated Balance Sheet one more time…

We can look at current assets and current liabilities to get a sense of the short term liquidity of the company before the bankruptcy. If you subtract inventory from short term assets, which is not always liquid because it requires revenues to convert to cash, the company had less current assets (working capital) than current liabilities.

We can speculate on many aspects of the company’s financials, but it’s hard to ignore the working capital situation after you adjust for unsold inventory. Without quick access to a revolving credit line or other sort of temporary funding, a single recessionary event can completely wipe out an otherwise strong company because of tight liquidity needs.

Investor Takeaway

What can we learn from this case study?

It may seem like a grim idea that investors can’t avoid systemic risk, can’t avoid black swans, and so are subject to the wild unpredictability that can wipe anyone out.

While this is true—an investor can also greatly limit exposure to companies like this.

It all comes down to potential downside risks.

You don’t have to invest in companies with large commitments such as Monaco disclosed in their 10-K. In fact, having large potential obligations in relation to their actual cash flows and earning power is not very common, at least with the companies I’ve been looking at lately.

The big lesson is that it pays to take deep dives with companies, and really analyze the worst case scenario.

Investing legend Charlie Munger calls this the idea of “Invert, always invert,” and “All I want to know is where I’m going to die so I’ll never go there.”

By looking at the worst case scenario, such as the major bankruptcies in 2009 and other challenging years, we can increase our odds of avoiding bets with larger potential downside.

In the case of Monaco, it’s simple: don’t sign a contract you probably can’t afford to pay if the world collapses.

Because every once in a while, for a short period of time, the world does.

Updated: 01/23/2023

Related posts:

- The Circuit City Bankruptcy: Hubris and Aggressive Overextension With hindsight, the Circuit City bankruptcy looked like a similar story to Blockbuster’s. It was innovation, new concepts and businesses, defeating the old. However, there...

- Applying the Lessons of Enron’s Mark-to-Market Accounting Scandal Today It may be surprising, but companies today are still using the same mark-to-market accounting that led to Enron’s fraud and bankruptcy in 2001. Mark-to-market accounting...

- The Best Way to Invest in Insurance Companies: How to Analyze Their Stocks Insurance, one of the necessary evils of today’s world, right? We all have to have it in case of that one day you will need...

- Float: How Insurance Companies Can Leverage Buffett’s Secret to Wealth In the insurance industry, “other people’s money” is known as float. In a shareholder letter, Warren Buffett once said that float “had cost us nothing...