Do me a favor and before you read anything further, go use the bathroom. Get yourself a drink. Eat a snack. Get ready, because this post about hosting an effective family finance meeting is legitimately one of the most lifechanging things that I think you can do for both yourself and your family.

If you’re reading this, I am guessing that you already have a solid grasp on your family finances, but does everyone in your family share that same passion?

Let me tell you about my own personal situation – in our family, I am the one that handles a large majority of the financial decisions. I manage our budget and make the investing decisions, but I am definitely not the only one that makes the large, important decisions about things like:

- Saving for large purchases

- Investing vs. paying off debt

- Determining the priority of investing (HSA vs. IRA vs. 401k vs. Etc.)

Admittedly, I have more knowledge on these topics than my wife does because I am a huge nerd that loves to continuously read and learn about the ways to make our money work for us in the most efficient way possible, but that doesn’t mean I make all of the decisions.

When we get a bonus, tax return or a stimulus check – it’s a discussion that begins with my recommendation for usage of the money, but doesn’t always end with it being used that way.

While I am personally one that’s more of a risk taker and would invest nearly all of our money, my wife is one that prefers the stability of a strong emergency fund and less monthly debt payments. Neither is right and neither is wrong, so we try to blend our two philosophies together to create a cohesive Family Finance Plan.

I am fortunate enough to have a partner that easily adopts all the suggestions that I have, such as living a minimalist life or having a “cheap week” for meal planning, but I know that not everyone is in that situation. Don’t worry, I will help you figure out what to do to accurately plan this meeting.

Step 1 – Find Out What is Important to Your Significant Other

Why would they care enough to participate in this family finance meeting?

Maybe they…

- Want to move into a house, or a bigger one, which obviously requires saving for a down payment

- Want to stop working altogether to spend time with the family

- Want to retire early

- Want to purchase a nicer car

- Want to be able to take a job where the money is irrelevant but it’s a dream job

- Want to pay for kid’s education

- You’re about to go broke and file for bankruptcy

- Want to go on a vacation

The list is honestly endless. You need to find out what they want so that you can tailor the meeting around that.

Just like how I talk about with your own personal finances, if you don’t know your ‘why’, then you’re going to fail when things get tough…and you can trust me because I am speaking from years of experience!

For my wife, her ‘why’ is being able to move into a nicer home and then having the ability to retire early/have a lake house. Both of these goals are things that I align with as well so that made it easier to convey the message.

Step 2 – Determine the Best Way to Concisely Communicate the Information

Maybe this is entirely verbal. Maybe it’s by creating a checklist of things in Microsoft Word that you can just walk through with them.

Find out what is best for your significant other in the way that they will be able to decipher the information.

For my wife, it was a short PowerPoint with literally nothing but charts. It was super simple to give a short framework of how we’re currently doing and then gave me the ability to “feel out” the conversation and expand where I needed but also not get too far in the weeds when I can tell it was something that wasn’t necessarily as important.

Step 3 – Find Your Significant Other’s Happy Place

“Go to your happy place.”

Yes, I am a huge fan of Adam Sandler meaning I obvi love Happy Gilmore, but this is really true. Find what’s going to put them in a great mood and do that. Is it first thing in the morning with coffee or after dinner with wine? Maybe you get a nice piece of chocolate cake and save the wine for after the dinner. Or, go out to a restaurant and print out that PowerPoint that you put together.

Whatever it is, offer up what you think will make your significant other the happiest so they’re prepared to discuss the topic at hand.

If things are stressful the day of – postpone. It’s not worth having the conversation only because it’s been on the calendar. You need to make sure your partner is truly ready to have this conversation since they’re likely already not enthusiastic about the idea.

Step 4 – Come Prepared for BOTH of You

When I say that you need to “come prepared”, I mean in many different ways:

- Be prepared to host and lead the entire conversation

- Prepare for how you want the meeting to go

- Have a general timeline in place for how long you think the meeting should last

- Have topics planned with probing questions to generate discussion

- Have all the essentials ready for the meeting

- Pens & Paper for Notes

- The presentation/PowerPoint if you plan to give one

- Drinks (If alcoholic, I recommend making sure you’re staying well within your tolerance), coffee, snacks

- Babysitter if you need someone to watch your kids. You want this session to be uninterrupted

- Leave your phone somewhere else so you’re not looking at it, even if your significant other does

- Action Items – Be prepared to give up your desired takeaways, such as:

- Reduce our food budget by $200/month

- Pay off one of our cars by the end of next year

- Start packing our lunch 2 days/week instead of eating out every day (this can have an insane impact)

- Max out our Roth IRA instead of holding money in an essentially worthless savings account since even the high-yield savings accounts are only earning about .5% currently.

- Drive Uber 1 day/week with the goal to make $50, or $2600 over the course of the year.

- Any sort of other goal regarding expense reduction and/or increasing your income is going to be a great goal that can further spark conversation.

If you can do these things, I think you’re going to be off to a great start. The conversation should flow naturally and if you’re prepared and your significant other is even a little receptive, I am sure that you can find some middle ground to implement some new ideas.

Just because you’re likely coming in with more experience of personal finance doesn’t mean that you’re always right, and you need to really listen to your partner about what they find important. If you don’t do this, then you’re going to be in trouble from the get-go and they’re simply just never going to buy into the process.

It might sound like this is going to be a ton of work but it’s really not. For me, putting the presentation together for my wife took less than an hour; the actual presentation was less than 10 minutes; and then we had about a half hour of just natural discussion that took place.

Putting together the presentation was really fast because I use Doctor Budget for my expense tracking so I could very easily go through and find our old expense information, net worth, etc., to input the information into a PowerPoint. Let me show you how it looked:

If you have read some of my previous posts, you likely know that I like to joke around and have fun, or as my wife says… “be trolly”. For that reason, I called it the “Shuler Town Hall” because we’re going to have these meetings quarterly!

The general process that I wanted to follow was to show the trends of our spending over the last year, then talk about our asset/net worth progress, and then end with the things that my wife really, really cared about.

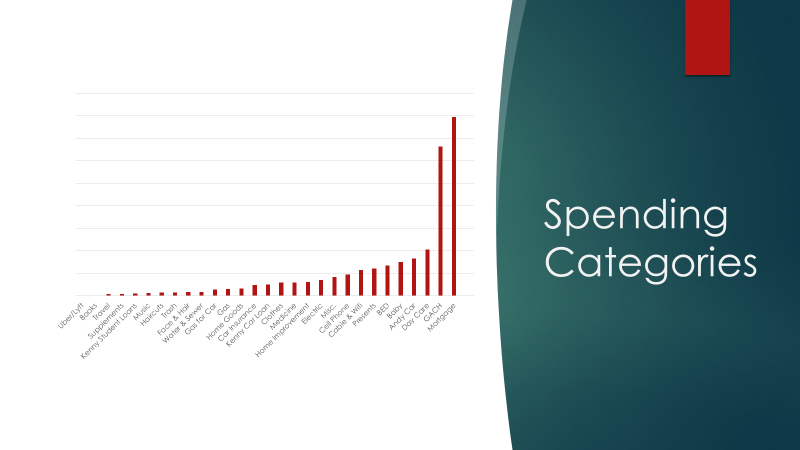

So, below show the spending categories over 2020:

Some of the categories might seem like foreign language, such as GACH which stands for “Groceries, Animals, Cleaning House” because a lot of those things I buy at the same place – Meijer. So, instead of breaking up my Meijer bill into different categories, I just know that Meijer = GACH.

And if it’s high that month, I know it’s because I’m not spending too much on the animals or on cleaning supplies…

But again, that’s why I love Doctor Budget because I can personalize it however, I need it, and it comes with a comprehensive list of some easy to miss budget categories.

By showing this spending, it likely will be eye opening where exactly our money is going. The one that really kills me is that Daycare is #3 on the list and our son has only been going there since July…. ugh.

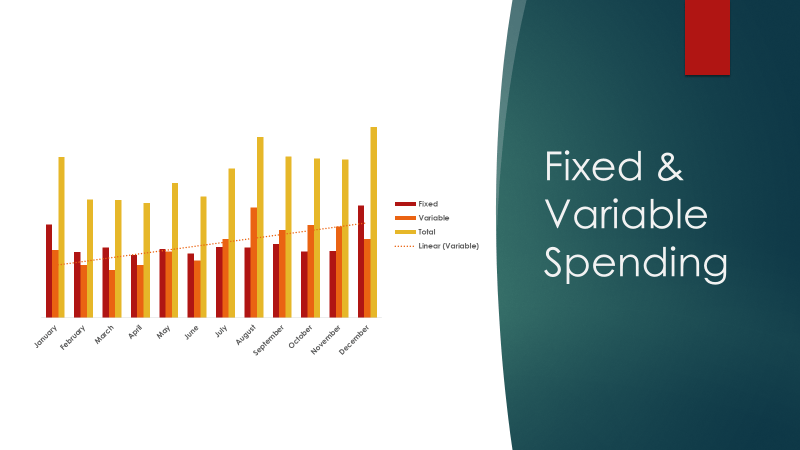

Next I breakdown this spending by Fixed and Variable, with a trendline, to show how our spending has been tracking:

As you can see, that trendline is pretty scary! It keeps going up quite a bit. Now, a lot of that is the daycare that I mentioned, but the trend still holds true. I list daycare as variable because it’s $200/week that’s cashed every Monday, so if the month has 4 Mondays then we owe $800, 5 Mondays is $200, etc. But, if we’re going on vacation and won’t take him for a week, we can use vacation and not pay that money.

So, it’s essentially a locked in cost but it definitely does change monthly.

The reason I include this is to show how our income is trending and then I included my own personal notes to say things like:

- XXX was on Christmas gifts

- XXX was on a 1-day trip we took in Michigan

- XXX was when we added to our home gym

That can probe conversation and then spark brainstorming about if those were essential and if they should be cut out in the 2021 spending or not.

Time to move on to the fun stuff – the Retirement savings!

I have it broken down by the 5 retirement accounts that we have – we both have a 401K and an IRA, and then we share an HSA. The bars go by month so we can see how our contributions have affected our total retirement.

If you’re wondering why I include the HSA, let me say this – it is THE BEST retirement tool out there. Outside of maxing out your company 401K match, this is by far the next best thing that you need to be adding to.

It’s tax free going in and coming out, and when you retire at age 65 you can pull it out for non-medical use. You will pay taxes at that point, so it’s still basically like a Traditional IRA, or you can just hold it forever and use for medical use.

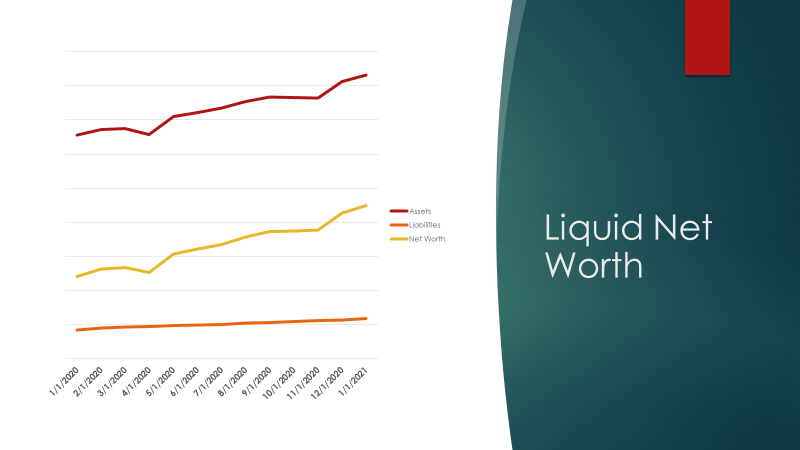

Now we’re onto our Liquid Net Worth!

You’ll notice that all three are going up, meaning we’re increasing our assets and decreasing our liabilities – a great 1-2-punch to increasing your net worth!

Of course, these graphs don’t mean a ton without the numbers, but I am not comfortable sharing that information, so this is the sort of framework you can provide when you’re having your family finance meeting.

I will then take our current numbers and use a compound interest calculator to back in to how much we need to save annually to be able to hit our retirement goal. This could get in the weeds a bit, so I always have this prepared ahead of time.

- If we save/invest XXX for 20 years, we will have XXX

- If we save/invest XXX + $5K for 20 years, we will have XXX

- If we want to retire by 55, we need to save/invest XXX

Doing this on the front end can keep you from scrambling during the meeting which inevitably creates some downtime for your significant other to become unfocused, get on their phone, use the restroom, etc. All things that are simply just barriers to actually reaching a good plan!

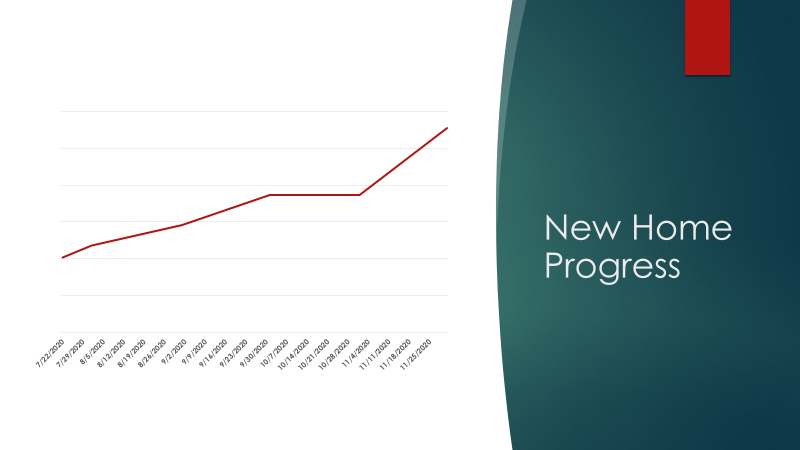

Now we get to the part my wife really cares about – a new home! I have been “teasing” this the entire presentation to keep her attention. Just how a grocery store puts the milk at the back of the store, I am putting this at the back of the presentation.

I then again will take these numbers on the graph and have some info prepared saying things like, “We can afford X currently” or “if we save X for another 2 years, we can then afford X”.

Since this is what your significant other really wants to talk about, then we really get the conversation flowing at this point which is the entire goal! We can brainstorm now and talk about some of our major goals for 2021 and how to accomplish them, leading me to…

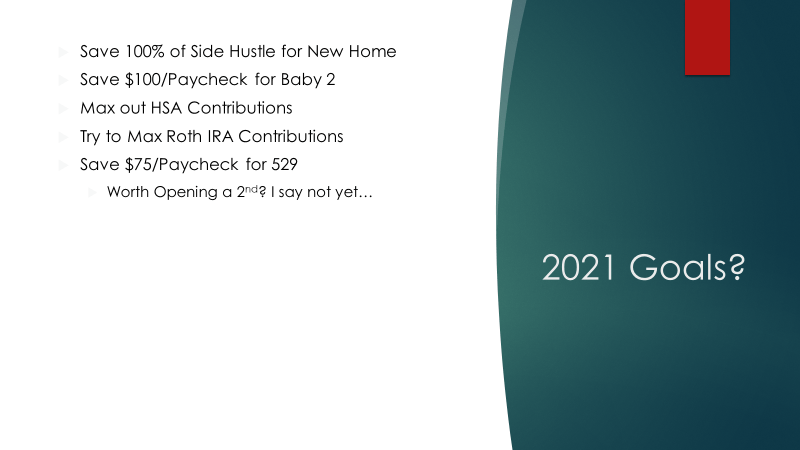

First, I will clarify by saying that we are not expecting a second child lol. But my wife’s employer let’s her take 20 weeks of maternity leave with the first 8 weeks being paid. She took the full 20 weeks for first son and I’d like for her to have that option again, so we need to start saving for 12 weeks of her not having a salary if that’s happening again.

And then I list out some of my goals for investing retirement and future college bills, as well as noting that my side hustle will 100% be used to save for our future new home.

Honestly, without a side hustle, saving for a new home would be next to impossible for us, and it’s why I think it’s one of the best ways to increase your income to hit your goals. For us, we view the retirement savings goals as nonnegotiable with our salary, so if we want to do anything extra (new home, vacations, new cars, etc.), it cannot come at the expense of our current savings.

How do we do that? Side hustle.

Summary

So, there you have it! That’s the exact presentation that I used with my wife and we had a great conversation. If you can follow these four steps of preparation, I guarantee that you’re going to be able to come away with some great action items for the next year!

- Find Out What is Important to Your Significant Other

- Determine the Best Way to Concisely Communicate the Information

- Find Your Significant Other’s Happy Place

- Come Prepared for BOTH of You

But remember, this is really just the kickoff meeting – don’t hesitate to have these as often as you need. If you want to start laying the groundwork even thicker than this, do what I did – explain the power of compound interest to your significant other.

Once I did that, everything seemed to click. All it took was some examples of how compound literally can be lifechanging!

Related posts:

- Your ‘How To’ Guide for Creating Generational Wealth for Your Family Do you ever wish that you knew more about personal finance earlier in your life? If not, you are in the minority, my friend. So...

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...

- No-Nonsense Financial Planning Guide for the DIY Individual (Pt1: Expenses) Success in financial planning comes down to a few key principles. Define your goals, curb your desires, and have patience and discipline. Make the right...

- The Average American is Drowning in Debt – Here’s Your Life Preserver This is a guest post from Joseph Hogue. As a financial advisor, I’ve seen the frustration Andrew talks about when he hears people just don’t...